The bidding war for the joint venture company Hulu has just ratcheted up – again. The second-largest American pay TV service, DIRECTV (NASDAQ:DTV), is reportedly offering upwards of $1 billion to acquire Hulu. Other companies currently jockeying for position in this war include Time Warner Inc (NYSE:TWX) and Yahoo! Inc. (NASDAQ:YHOO), among others.

As the Hulu board deliberates over at least seven buyout offers, consider this: how will a Hulu buyout reorient the constellation of online video streaming? Hulu has grown dramatically in the United States and is certainly an attractive takeover target, as evidenced by its seven suitors. Whoever ends up with Hulu will be competition for Netflix, Inc. (NASDAQ:NFLX). However, Hulu is a website that currently serves only the United States. In the short term, a Hulu buyout will probably not pose much of a threat to any company with a strong international presence.

Background on Hulu

Hulu is a subscription service that offers ad-supported on-demand video streaming. It is owned by The Walt Disney Company (NYSE:DIS), News Corp (NASDAQ:NWSA), and Comcast Corporation (NASDAQ:CMCSA). Several companies are apparently willing to jump through hoops to acquire it as Hulu had a very successful 2012 and continues to grow:

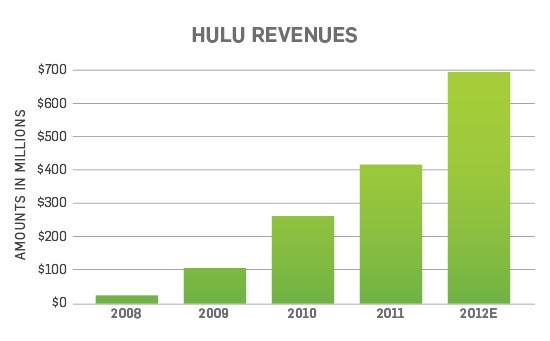

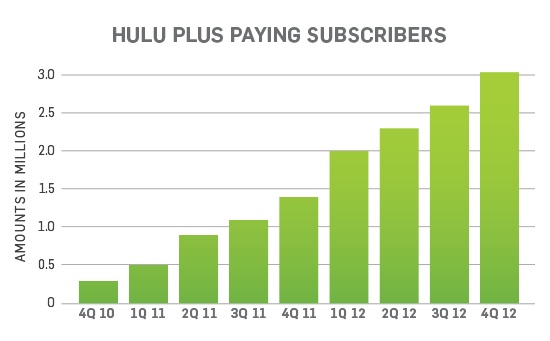

Hulu garnered $695 million in revenue in 2012 – a 65% increase over 2011. Hulu currently has 3 million subscribers to its Hulu Plus service and rolled out Hulu Plus on Apple TV, Windows 8 tablets, Nintendo Wii and Wii U, and many Android tablets and phones in 2012.

The impact of a potential buyout

Hulu has demonstrated a propensity to continue to grow at a solid rate. Thus, whoever buys Hulu has a good chance of getting on the boat – and so do investors of the company that prevails.

Admittedly, there is no way for us to find out what package Hulu is leaning towards because the deliberations are private. Hulu is reportedly planning on narrowing down the options to three or four proposals over the next few weeks. However, it is possible to analyze the potential impact a Hulu buyout will have on the market and individual companies moving forward.

A Hulu buyout will put the buyer in direct competition with Netflix – but only in the United States. Hulu and Netflix are already competing for consumer dollars and eyeballs. The market for content, particularly exclusive content, has heated up over the last couple years. However, Netflix is a much larger operation than Hulu – over $3 billion in revenues for Netflix, versus $695 million for Hulu. Netflix could be able to absorb the impact of some of its users going to Hulu short-term because of Netflix’s international presence. In fact, some consumers might even decide to use both Hulu and Netflix.

DIRECTV (NASDAQ:DTV) could certainly use Hulu to help reach a large Internet audience for much lower overhead costs than DIRECTV’s traditional line of satellite dish operations. The satellite TV industry as a whole is no longer a growth industry as cable-cutting and the popularity of online content has been on the rise. DIRECTV has been doing fairly well in 2013 and would increase financial flexibility, produce better operating margins, and become more competitive with Dish Network if it gets hold of Hulu. If DIRECTV loses out to Time Warner Inc (NYSE:TWX) or another company, DIRECTV (NASDAQ:DTV) investors can take solace in the fact that, as of now, DIRECTV appears to be holding its own even as more traditional forms of cable are slowly starting to lose their luster.

Yahoo! Inc. (NASDAQ:YHOO) is perhaps the most intriguing suitor to Hulu. Yahoo! has been on an interesting run-up under the helm of former Google employee Marissa Mayer. The company has bought various smaller companies and services, and recently acquired the popular website Tumblr. Although Tumblr is popular, it appears that monetizing Tumblr will prove difficult at best for Yahoo!. Hulu would most likely benefit Yahoo!, as the company would be able to provide its users with another area of online content and give them a key reason to continue visiting the website. Yahoo! Inc. (NASDAQ:YHOO) would open up a new front of competition on itself, however. If Yahoo! does buy Hulu, it would go head to head with Netflix. Considering that DIRECTV (NASDAQ:DTV) is a $27 billion corporation versus Yahoo!’s $4 billion, DIRECTV has a much larger war chest that it can utilize to help promote Hulu than Yahoo! does. DIRECTV would probably be able to more effectively monetize Hulu than Yahoo! Inc. (NASDAQ:YHOO).

Bottom line

Hulu has demonstrated a strong propensity to grind out profits and boost its subscription base. Whoever ends up with Hulu will pose competition to Netflix in the United States and keep Netflix’s feet to the fire. DIRECTV would be able to develop Hulu and reach audiences quicker than Yahoo! would be able to due to DIRECTV (NASDAQ:DTV)’s stronger current corporate structure. Hulu would also benefit DIRECTV in more tangible ways than it would benefit Yahoo! Inc. (NASDAQ:YHOO), since a Hulu purchase would transition DIRECTV into more of an internet company.

Evan Buck has no position in any stocks mentioned. The Motley Fool recommends DirecTV and Netflix. The Motley Fool owns shares of Netflix

The article Jumping Through the Hulu Hoops originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.