How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Vishay Intertechnology (NYSE:VSH) and determine whether hedge funds had an edge regarding this stock.

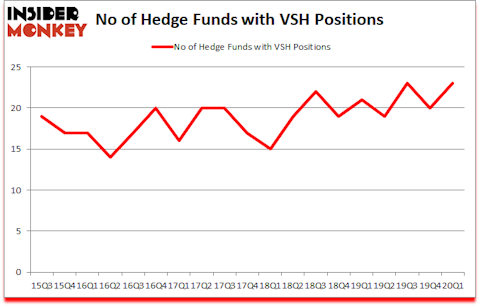

Is Vishay Intertechnology (NYSE:VSH) worth your attention right now? Hedge funds were betting on the stock. The number of bullish hedge fund positions advanced by 3 in recent months. Our calculations also showed that VSH isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are assumed to be slow, old investment vehicles of the past. While there are greater than 8000 funds trading at the moment, Our experts choose to focus on the bigwigs of this club, about 850 funds. These money managers oversee the lion’s share of all hedge funds’ total capital, and by keeping track of their first-class picks, Insider Monkey has figured out numerous investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Chuck Royce of Royce & Associates

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, on one site we found out that NBA champion Isiah Thomas is now the CEO of this cannabis company. The same site also talks about a snack manufacturer that’s growing at 30% annually. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Now we’re going to take a gander at the key hedge fund action regarding Vishay Intertechnology (NYSE:VSH).

How have hedgies been trading Vishay Intertechnology (NYSE:VSH)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the fourth quarter of 2019. On the other hand, there were a total of 21 hedge funds with a bullish position in VSH a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, AQR Capital Management, managed by Cliff Asness, holds the number one position in Vishay Intertechnology (NYSE:VSH). AQR Capital Management has a $70.1 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Fisher Asset Management, managed by Ken Fisher, which holds a $59.9 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism include Cynthia Paul’s Lynrock Lake, Chuck Royce’s Royce & Associates and Michael Rockefeller and KarláKroeker’s Woodline Partners. In terms of the portfolio weights assigned to each position Lynrock Lake allocated the biggest weight to Vishay Intertechnology (NYSE:VSH), around 4.98% of its 13F portfolio. Mountaineer Partners Management is also relatively very bullish on the stock, earmarking 3.38 percent of its 13F equity portfolio to VSH.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Lynrock Lake, managed by Cynthia Paul, assembled the biggest position in Vishay Intertechnology (NYSE:VSH). Lynrock Lake had $50.5 million invested in the company at the end of the quarter. Michael Rockefeller and KarláKroeker’s Woodline Partners also made a $10.7 million investment in the stock during the quarter. The following funds were also among the new VSH investors: Ian Simm’s Impax Asset Management, Tim Curro’s Value Holdings LP, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s go over hedge fund activity in other stocks similar to Vishay Intertechnology (NYSE:VSH). These stocks are Simmons First National Corporation (NASDAQ:SFNC), Diodes Incorporated (NASDAQ:DIOD), DouYu International Holdings Limited (NASDAQ:DOYU), and Sterling Bancorp (NYSE:STL). This group of stocks’ market valuations are closest to VSH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFNC | 4 | 2712 | -2 |

| DIOD | 13 | 49641 | -5 |

| DOYU | 15 | 30200 | 9 |

| STL | 25 | 176182 | -5 |

| Average | 14.25 | 64684 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $267 million in VSH’s case. Sterling Bancorp (NYSE:STL) is the most popular stock in this table. On the other hand Simmons First National Corporation (NASDAQ:SFNC) is the least popular one with only 4 bullish hedge fund positions. Vishay Intertechnology (NYSE:VSH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but beat the market by 15.5 percentage points. Unfortunately VSH wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on VSH were disappointed as the stock returned 6.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Vishay Intertechnology Inc (NYSE:VSH)

Follow Vishay Intertechnology Inc (NYSE:VSH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.