The latest 13F reporting period has come and gone, and Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. Now, we are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article you are going to find out whether hedge funds thoughtEquitrans Midstream Corporation (NYSE:ETRN) was a good investment heading into the second quarter and how the stock traded in comparison to the top hedge fund picks.

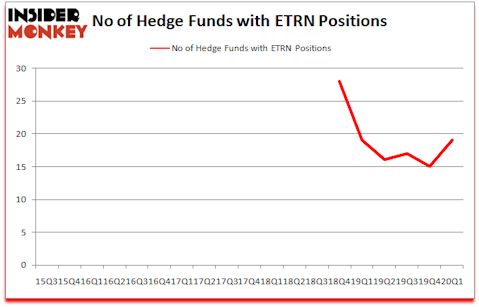

Equitrans Midstream Corporation (NYSE:ETRN) has seen an increase in hedge fund interest recently. Our calculations also showed that ETRN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Michael Lowenstein of Kensico Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Cannabis stocks are roaring back in 2020, so we are checking out this under-the-radar stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Now let’s take a glance at the key hedge fund action regarding Equitrans Midstream Corporation (NYSE:ETRN).

Hedge fund activity in Equitrans Midstream Corporation (NYSE:ETRN)

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ETRN over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Equitrans Midstream Corporation (NYSE:ETRN) was held by Scopia Capital, which reported holding $58 million worth of stock at the end of September. It was followed by Kensico Capital with a $47.6 million position. Other investors bullish on the company included Iridian Asset Management, Redwood Capital Management, and Point72 Asset Management. In terms of the portfolio weights assigned to each position Scopia Capital allocated the biggest weight to Equitrans Midstream Corporation (NYSE:ETRN), around 5.31% of its 13F portfolio. Deep Basin Capital is also relatively very bullish on the stock, earmarking 4.14 percent of its 13F equity portfolio to ETRN.

Consequently, specific money managers have jumped into Equitrans Midstream Corporation (NYSE:ETRN) headfirst. Scopia Capital, managed by Matt Sirovich and Jeremy Mindich, created the largest position in Equitrans Midstream Corporation (NYSE:ETRN). Scopia Capital had $58 million invested in the company at the end of the quarter. Matt Smith’s Deep Basin Capital also initiated a $16.3 million position during the quarter. The other funds with brand new ETRN positions are Benjamin A. Smith’s Laurion Capital Management, Karim Abbadi and Edward McBride’s Centiva Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Equitrans Midstream Corporation (NYSE:ETRN) but similarly valued. These stocks are Argo Group International Holdings, Ltd. (NYSE:ARGO), Sasol Limited (NYSE:SSL), Mueller Water Products, Inc. (NYSE:MWA), and McGrath RentCorp (NASDAQ:MGRC). This group of stocks’ market caps resemble ETRN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARGO | 16 | 138003 | -3 |

| SSL | 9 | 4982 | 2 |

| MWA | 20 | 180904 | 0 |

| MGRC | 20 | 90738 | 0 |

| Average | 16.25 | 103657 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $104 million. That figure was $228 million in ETRN’s case. Mueller Water Products, Inc. (NYSE:MWA) is the most popular stock in this table. On the other hand Sasol Limited (NYSE:SSL) is the least popular one with only 9 bullish hedge fund positions. Equitrans Midstream Corporation (NYSE:ETRN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 18.6% in 2020 through July 27th but still beat the market by 17.1 percentage points. Hedge funds were also right about betting on ETRN as the stock returned 88.2% since Q1 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Midstream Co Llc (NYSE:ETRN)

Follow Midstream Co Llc (NYSE:ETRN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.