We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Avalara, Inc. (NYSE:AVLR) and determine whether hedge funds skillfully traded this stock.

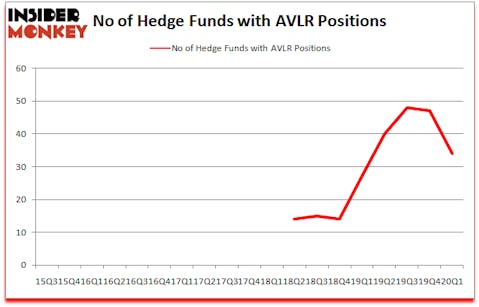

Is Avalara, Inc. (NYSE:AVLR) going to take off soon? The best stock pickers were reducing their bets on the stock. The number of bullish hedge fund bets were cut by 13 recently. Our calculations also showed that AVLR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). AVLR was in 34 hedge funds’ portfolios at the end of March. There were 47 hedge funds in our database with AVLR positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are viewed as slow, outdated financial vehicles of years past. While there are over 8000 funds in operation at the moment, We look at the top tier of this group, about 850 funds. It is estimated that this group of investors have their hands on most of the hedge fund industry’s total asset base, and by observing their top stock picks, Insider Monkey has determined a few investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. There is a lot of volatility in the markets and this presents amazing investment opportunities from time to time. For example, this trader claims to deliver juiced up returns with one trade a week, so we are checking out his highest conviction idea. A second trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a look at the new hedge fund action regarding Avalara, Inc. (NYSE:AVLR).

How have hedgies been trading Avalara, Inc. (NYSE:AVLR)?

Heading into the second quarter of 2020, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -28% from the fourth quarter of 2019. By comparison, 27 hedge funds held shares or bullish call options in AVLR a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

More specifically, Alkeon Capital Management was the largest shareholder of Avalara, Inc. (NYSE:AVLR), with a stake worth $178.2 million reported as of the end of September. Trailing Alkeon Capital Management was Renaissance Technologies, which amassed a stake valued at $171.8 million. Whale Rock Capital Management, Tensile Capital, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tensile Capital allocated the biggest weight to Avalara, Inc. (NYSE:AVLR), around 20.32% of its 13F portfolio. Broad Bay Capital is also relatively very bullish on the stock, designating 10.72 percent of its 13F equity portfolio to AVLR.

Since Avalara, Inc. (NYSE:AVLR) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of fund managers that decided to sell off their entire stakes heading into Q4. Intriguingly, Spencer M. Waxman’s Shannon River Fund Management cut the biggest stake of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $22.2 million in stock. Ryan Tolkin (CIO)’s fund, Schonfeld Strategic Advisors, also dropped its stock, about $10.6 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 13 funds heading into Q4.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Avalara, Inc. (NYSE:AVLR) but similarly valued. These stocks are MGM Resorts International (NYSE:MGM), Post Holdings Inc (NYSE:POST), HubSpot Inc (NYSE:HUBS), and Royal Gold, Inc (NASDAQ:RGLD). This group of stocks’ market valuations resemble AVLR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGM | 50 | 943490 | 0 |

| POST | 31 | 1195411 | -7 |

| HUBS | 27 | 662117 | -3 |

| RGLD | 28 | 237256 | -2 |

| Average | 34 | 759569 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $760 million. That figure was $970 million in AVLR’s case. MGM Resorts International (NYSE:MGM) is the most popular stock in this table. On the other hand HubSpot Inc (NYSE:HUBS) is the least popular one with only 27 bullish hedge fund positions. Avalara, Inc. (NYSE:AVLR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th and still beat the market by 15.5 percentage points. A small number of hedge funds were also right about betting on AVLR as the stock returned 78.4% during the second quarter and outperformed the market by an even larger margin.

Follow Avalara Inc. (NYSE:AVLR)

Follow Avalara Inc. (NYSE:AVLR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.