Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is U.S. Lime & Minerals Inc. (NASDAQ:USLM), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

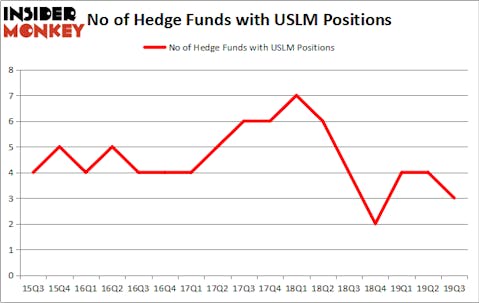

Is U.S. Lime & Minerals Inc. (NASDAQ:USLM) worth your attention right now? Money managers are getting less optimistic. The number of bullish hedge fund bets shrunk by 1 lately. Our calculations also showed that USLM isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Jeffrey Bronchick of Cove Street Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the recent hedge fund action encompassing U.S. Lime & Minerals Inc. (NASDAQ:USLM).

How are hedge funds trading U.S. Lime & Minerals Inc. (NASDAQ:USLM)?

At Q3’s end, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in USLM over the last 17 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in U.S. Lime & Minerals Inc. (NASDAQ:USLM), which was worth $17.3 million at the end of the third quarter. On the second spot was Minerva Advisors which amassed $11.1 million worth of shares. Cove Street Capital was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Minerva Advisors allocated the biggest weight to U.S. Lime & Minerals Inc. (NASDAQ:USLM), around 6.17% of its portfolio. Cove Street Capital is also relatively very bullish on the stock, dishing out 0.17 percent of its 13F equity portfolio to USLM.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Emancipation Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified USLM as a viable investment and initiated a position in the stock.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as U.S. Lime & Minerals Inc. (NASDAQ:USLM) but similarly valued. We will take a look at Evolus, Inc. (NASDAQ:EOLS), Jernigan Capital Inc (NYSE:JCAP), Luxfer Holdings PLC (NYSE:LXFR), and CONSOL Energy Inc. (NYSE:CEIX). All of these stocks’ market caps are similar to USLM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EOLS | 7 | 12894 | -5 |

| JCAP | 13 | 43400 | -2 |

| LXFR | 11 | 67175 | 2 |

| CEIX | 20 | 60398 | 4 |

| Average | 12.75 | 45967 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $30 million in USLM’s case. CONSOL Energy Inc. (NYSE:CEIX) is the most popular stock in this table. On the other hand Evolus, Inc. (NASDAQ:EOLS) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks U.S. Lime & Minerals Inc. (NASDAQ:USLM) is even less popular than EOLS. Hedge funds clearly dropped the ball on USLM as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. A small number of hedge funds were also right about betting on USLM as the stock returned 22.3% during the fourth quarter (through 11/22) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.