Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Tronox Holdings plc (NYSE:TROX).

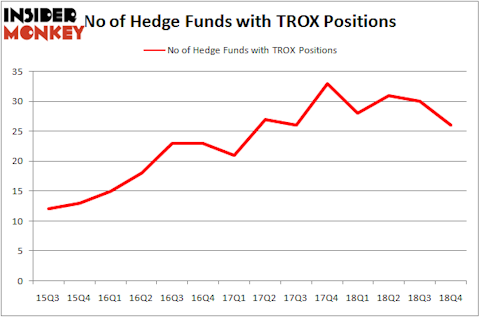

Tronox Holdings plc (NYSE:TROX) investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. TROX was in 26 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 30 hedge funds in our database with TROX holdings at the end of the previous quarter. Our calculations also showed that TROX isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the latest hedge fund action encompassing Tronox Holdings plc (NYSE:TROX).

How have hedgies been trading Tronox Holdings plc (NYSE:TROX)?

Heading into the first quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from one quarter earlier. On the other hand, there were a total of 28 hedge funds with a bullish position in TROX a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Among these funds, Anchorage Advisors held the most valuable stake in Tronox Holdings plc (NYSE:TROX), which was worth $32.7 million at the end of the fourth quarter. On the second spot was Fine Capital Partners which amassed $21.4 million worth of shares. Moreover, Luminus Management, Private Capital Management, and Point72 Asset Management were also bullish on Tronox Holdings plc (NYSE:TROX), allocating a large percentage of their portfolios to this stock.

Due to the fact that Tronox Holdings plc (NYSE:TROX) has faced declining sentiment from the smart money, it’s easy to see that there was a specific group of hedgies who sold off their entire stakes by the end of the third quarter. At the top of the heap, Carl Tiedemann and Michael Tiedemann’s TIG Advisors cut the largest stake of all the hedgies watched by Insider Monkey, comprising an estimated $16.6 million in stock, and Howard Guberman’s Gruss Asset Management was right behind this move, as the fund dropped about $8.4 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 4 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Tronox Holdings plc (NYSE:TROX) but similarly valued. We will take a look at Easterly Government Properties Inc (NYSE:DEA), Goosehead Insurance, Inc. (NASDAQ:GSHD), Harmony Gold Mining Company Limited (NYSE:HMY), and Solid Biosciences Inc. (NASDAQ:SLDB). This group of stocks’ market caps are similar to TROX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DEA | 5 | 121754 | -3 |

| GSHD | 3 | 8605 | -1 |

| HMY | 7 | 19643 | 0 |

| SLDB | 11 | 284601 | -6 |

| Average | 6.5 | 108651 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $144 million in TROX’s case. Solid Biosciences Inc. (NASDAQ:SLDB) is the most popular stock in this table. On the other hand Goosehead Insurance, Inc. (NASDAQ:GSHD) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Tronox Holdings plc (NYSE:TROX) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on TROX as the stock returned 96.1% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.