How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Telenav Inc (NASDAQ:TNAV).

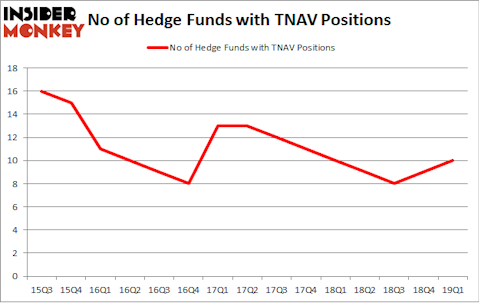

Telenav Inc (NASDAQ:TNAV) has seen an increase in hedge fund interest of late. TNAV was in 10 hedge funds’ portfolios at the end of March. There were 9 hedge funds in our database with TNAV positions at the end of the previous quarter. Our calculations also showed that tnav isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are seen as worthless, old investment vehicles of the past. While there are more than 8000 funds in operation at present, Our experts choose to focus on the moguls of this group, around 750 funds. These hedge fund managers manage the lion’s share of all hedge funds’ total asset base, and by following their top stock picks, Insider Monkey has unearthed various investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s check out the key hedge fund action regarding Telenav Inc (NASDAQ:TNAV).

How are hedge funds trading Telenav Inc (NASDAQ:TNAV)?

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from the fourth quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in TNAV a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Nokomis Capital was the largest shareholder of Telenav Inc (NASDAQ:TNAV), with a stake worth $29.1 million reported as of the end of March. Trailing Nokomis Capital was Divisar Capital, which amassed a stake valued at $23.7 million. Ariel Investments, Renaissance Technologies, and Ancora Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, specific money managers were breaking ground themselves. Lyon Street Capital, managed by Brian C. Freckmann, assembled the most outsized position in Telenav Inc (NASDAQ:TNAV). Lyon Street Capital had $0.9 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also initiated a $0 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Telenav Inc (NASDAQ:TNAV) but similarly valued. We will take a look at Alpha and Omega Semiconductor Ltd (NASDAQ:AOSL), Digital Turbine Inc (NASDAQ:APPS), American Superconductor Corporation (NASDAQ:AMSC), and Solar Senior Capital Ltd (NASDAQ:SUNS). This group of stocks’ market valuations match TNAV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AOSL | 11 | 42571 | 0 |

| APPS | 15 | 17435 | 5 |

| AMSC | 16 | 46521 | 9 |

| SUNS | 2 | 851 | 1 |

| Average | 11 | 26845 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $76 million in TNAV’s case. American Superconductor Corporation (NASDAQ:AMSC) is the most popular stock in this table. On the other hand Solar Senior Capital Ltd (NASDAQ:SUNS) is the least popular one with only 2 bullish hedge fund positions. Telenav Inc (NASDAQ:TNAV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on TNAV as the stock returned 27.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.