Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Sunrun Inc (NASDAQ:RUN), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

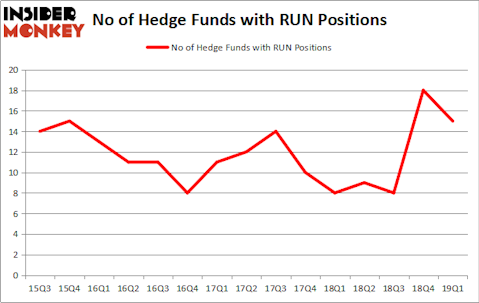

Sunrun Inc (NASDAQ:RUN) has experienced a decrease in hedge fund interest of late. Our calculations also showed that RUN isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are viewed as worthless, old financial tools of yesteryear. While there are over 8000 funds with their doors open today, Our experts look at the crème de la crème of this group, around 750 funds. It is estimated that this group of investors shepherd most of the hedge fund industry’s total asset base, and by tracking their finest picks, Insider Monkey has uncovered a number of investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the recent hedge fund action encompassing Sunrun Inc (NASDAQ:RUN).

What does smart money think about Sunrun Inc (NASDAQ:RUN)?

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in RUN a year ago. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Tiger Global Management was the largest shareholder of Sunrun Inc (NASDAQ:RUN), with a stake worth $261.3 million reported as of the end of March. Trailing Tiger Global Management was Ardsley Partners, which amassed a stake valued at $21 million. Hudson Bay Capital Management, Citadel Investment Group, and MD Sass were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Sunrun Inc (NASDAQ:RUN) has experienced falling interest from hedge fund managers, it’s easy to see that there exists a select few fund managers that elected to cut their full holdings by the end of the third quarter. Interestingly, Richard Driehaus’s Driehaus Capital sold off the biggest stake of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $7.3 million in stock. Steve Cohen’s fund, Point72 Asset Management, also dropped its stock, about $4.4 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Sunrun Inc (NASDAQ:RUN). These stocks are American Axle & Manufacturing Holdings, Inc. (NYSE:AXL), Virtusa Corporation (NASDAQ:VRTU), B&G Foods, Inc. (NYSE:BGS), and PROS Holdings, Inc. (NYSE:PRO). This group of stocks’ market values are closest to RUN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXL | 19 | 126147 | -5 |

| VRTU | 10 | 63089 | -4 |

| BGS | 19 | 195714 | 9 |

| PRO | 19 | 159084 | 4 |

| Average | 16.75 | 136009 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $136 million. That figure was $306 million in RUN’s case. American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) is the most popular stock in this table. On the other hand Virtusa Corporation (NASDAQ:VRTU) is the least popular one with only 10 bullish hedge fund positions. Sunrun Inc (NASDAQ:RUN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on RUN as the stock returned 29.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.