A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended December 31, so let’s proceed with the discussion of the hedge fund sentiment on SAGE Therapeutics Inc (NASDAQ:SAGE).

SAGE Therapeutics Inc (NASDAQ:SAGE) has experienced a decrease in hedge fund interest recently. Our calculations also showed that SAGE isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are numerous metrics stock traders can use to grade publicly traded companies. Two of the less known metrics are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the top hedge fund managers can outperform the market by a solid margin (see the details here).

Let’s take a look at the latest hedge fund action encompassing SAGE Therapeutics Inc (NASDAQ:SAGE).

How have hedgies been trading SAGE Therapeutics Inc (NASDAQ:SAGE)?

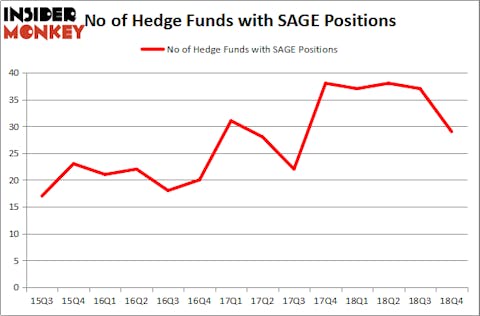

At Q4’s end, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards SAGE over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Palo Alto Investors was the largest shareholder of SAGE Therapeutics Inc (NASDAQ:SAGE), with a stake worth $81.5 million reported as of the end of September. Trailing Palo Alto Investors was Partner Fund Management, which amassed a stake valued at $48.4 million. Farallon Capital, Casdin Capital, and Point72 Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since SAGE Therapeutics Inc (NASDAQ:SAGE) has witnessed declining sentiment from the smart money, it’s safe to say that there is a sect of fund managers that decided to sell off their positions entirely by the end of the third quarter. It’s worth mentioning that Julian Baker and Felix Baker’s Baker Bros. Advisors dumped the biggest investment of the 700 funds tracked by Insider Monkey, worth about $80.2 million in stock, and Peter Kolchinsky’s RA Capital Management was right behind this move, as the fund dumped about $49.6 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 8 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as SAGE Therapeutics Inc (NASDAQ:SAGE) but similarly valued. These stocks are MongoDB, Inc. (NASDAQ:MDB), Curtiss-Wright Corp. (NYSE:CW), United States Cellular Corporation (NYSE:USM), and Buckeye Partners, L.P. (NYSE:BPL). This group of stocks’ market valuations are similar to SAGE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDB | 23 | 510104 | 2 |

| CW | 20 | 355686 | -2 |

| USM | 17 | 208533 | 2 |

| BPL | 5 | 6109 | 0 |

| Average | 16.25 | 270108 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $270 million. That figure was $331 million in SAGE’s case. MongoDB, Inc. (NASDAQ:MDB) is the most popular stock in this table. On the other hand Buckeye Partners, L.P. (NYSE:BPL) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks SAGE Therapeutics Inc (NASDAQ:SAGE) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on SAGE as the stock returned 72.8% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.