Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of RenaissanceRe Holdings Ltd. (NYSE:RNR).

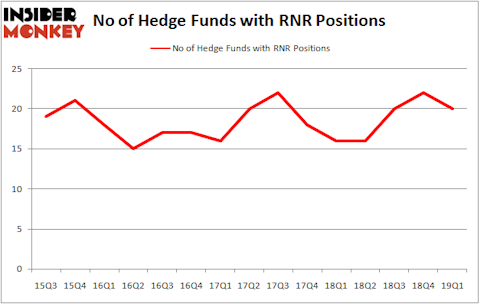

Is RenaissanceRe Holdings Ltd. (NYSE:RNR) the right pick for your portfolio? Investors who are in the know are in a bearish mood. The number of bullish hedge fund positions were trimmed by 2 recently. Our calculations also showed that RNR isn’t among the 30 most popular stocks among hedge funds. RNR was in 20 hedge funds’ portfolios at the end of the first quarter of 2019. There were 22 hedge funds in our database with RNR positions at the end of the previous quarter.

To the average investor there are tons of gauges market participants use to evaluate publicly traded companies. A couple of the less utilized gauges are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can trounce the broader indices by a solid margin (see the details here).

Let’s go over the recent hedge fund action surrounding RenaissanceRe Holdings Ltd. (NYSE:RNR).

How are hedge funds trading RenaissanceRe Holdings Ltd. (NYSE:RNR)?

Heading into the second quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in RNR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of RenaissanceRe Holdings Ltd. (NYSE:RNR), with a stake worth $184.4 million reported as of the end of March. Trailing Renaissance Technologies was Abrams Bison Investments, which amassed a stake valued at $89.8 million. Polar Capital, Diamond Hill Capital, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that RenaissanceRe Holdings Ltd. (NYSE:RNR) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there was a specific group of fund managers that slashed their positions entirely by the end of the third quarter. At the top of the heap, John D. Gillespie’s Prospector Partners dumped the largest stake of the 700 funds watched by Insider Monkey, comprising an estimated $10.7 million in stock. Daniel Lascano’s fund, Lomas Capital Management, also cut its stock, about $6.5 million worth. These moves are interesting, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to RenaissanceRe Holdings Ltd. (NYSE:RNR). We will take a look at Park Hotels & Resorts Inc. (NYSE:PK), Starwood Property Trust, Inc. (NYSE:STWD), New Residential Investment Corp (NYSE:NRZ), and EnLink Midstream LLC (NYSE:ENLC). This group of stocks’ market valuations match RNR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PK | 14 | 503382 | -3 |

| STWD | 15 | 144343 | -2 |

| NRZ | 18 | 187262 | -7 |

| ENLC | 10 | 39338 | -5 |

| Average | 14.25 | 218581 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $219 million. That figure was $501 million in RNR’s case. New Residential Investment Corp (NYSE:NRZ) is the most popular stock in this table. On the other hand EnLink Midstream LLC (NYSE:ENLC) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks RenaissanceRe Holdings Ltd. (NYSE:RNR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on RNR as the stock returned 20.3% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.