We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) based on that data.

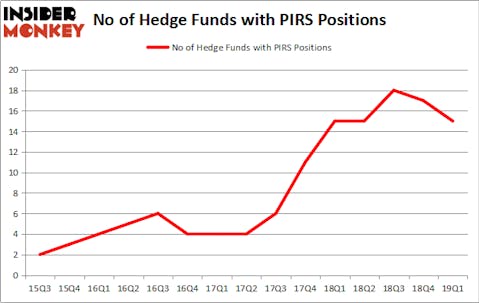

Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) investors should pay attention to a decrease in hedge fund sentiment lately. Our calculations also showed that PIRS isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of indicators stock market investors can use to grade their stock investments. A couple of the most under-the-radar indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best money managers can outclass their index-focused peers by a significant margin (see the details here).

We’re going to view the key hedge fund action encompassing Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS).

How are hedge funds trading Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PIRS over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Biotechnology Value Fund / BVF Inc held the most valuable stake in Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS), which was worth $13.6 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $7 million worth of shares. Moreover, Nantahala Capital Management, Aquilo Capital Management, and Millennium Management were also bullish on Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS), allocating a large percentage of their portfolios to this stock.

Seeing as Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) has faced bearish sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of funds that elected to cut their full holdings in the third quarter. At the top of the heap, Lawrence Hawkins’s Prosight Capital dropped the biggest position of the 700 funds tracked by Insider Monkey, totaling close to $0.9 million in stock, and Jonathan Auerbach’s Hound Partners was right behind this move, as the fund dropped about $0.3 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) but similarly valued. These stocks are Goodrich Petroleum Corporation (NYSE:GDP), Adams Resources & Energy Inc (NYSEAMEX:AE), Riverview Bancorp, Inc. (NASDAQ:RVSB), and Nautilus, Inc. (NYSE:NLS). This group of stocks’ market values match PIRS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDP | 6 | 30805 | 0 |

| AE | 3 | 13008 | 0 |

| RVSB | 8 | 4513 | 0 |

| NLS | 13 | 24880 | -3 |

| Average | 7.5 | 18302 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $38 million in PIRS’s case. Nautilus, Inc. (NYSE:NLS) is the most popular stock in this table. On the other hand Adams Resources & Energy Inc (NYSEAMEX:AE) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on PIRS as the stock returned 28.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.