The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Molecular Templates, Inc. (NASDAQ:MTEM), and what that likely means for the prospects of the company and its stock.

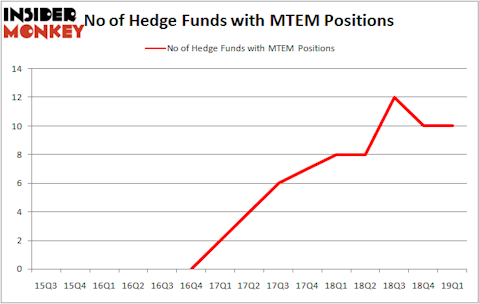

Molecular Templates, Inc. (NASDAQ:MTEM) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of March. At the end of this article we will also compare MTEM to other stocks including The Bank of Princeton (NASDAQ:BPRN), THL Credit, Inc. (NASDAQ:TCRD), and Liquidia Technologies, Inc. (NASDAQ:LQDA) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action regarding Molecular Templates, Inc. (NASDAQ:MTEM).

How are hedge funds trading Molecular Templates, Inc. (NASDAQ:MTEM)?

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the fourth quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in MTEM a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

More specifically, Biotechnology Value Fund / BVF Inc was the largest shareholder of Molecular Templates, Inc. (NASDAQ:MTEM), with a stake worth $20.8 million reported as of the end of March. Trailing Biotechnology Value Fund / BVF Inc was Perceptive Advisors, which amassed a stake valued at $11.5 million. Kingdon Capital, Sectoral Asset Management, and Prosight Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Since Molecular Templates, Inc. (NASDAQ:MTEM) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there is a sect of fund managers who sold off their entire stakes last quarter. At the top of the heap, David Lohman’s Diag Capital cut the biggest stake of the 700 funds monitored by Insider Monkey, comprising an estimated $1 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dropped its stock, about $0 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Molecular Templates, Inc. (NASDAQ:MTEM) but similarly valued. We will take a look at The Bank of Princeton (NASDAQ:BPRN), THL Credit, Inc. (NASDAQ:TCRD), Liquidia Technologies, Inc. (NASDAQ:LQDA), and Global Water Resources, Inc. (NASDAQ:GWRS). This group of stocks’ market valuations match MTEM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BPRN | 3 | 16404 | -1 |

| TCRD | 6 | 22612 | 1 |

| LQDA | 11 | 28517 | 8 |

| GWRS | 6 | 9879 | -1 |

| Average | 6.5 | 19353 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $42 million in MTEM’s case. Liquidia Technologies, Inc. (NASDAQ:LQDA) is the most popular stock in this table. On the other hand The Bank of Princeton (NASDAQ:BPRN) is the least popular one with only 3 bullish hedge fund positions. Molecular Templates, Inc. (NASDAQ:MTEM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on MTEM as the stock returned 38.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.