We can judge whether Liberty Latin America Ltd. (NASDAQ:LILAK) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

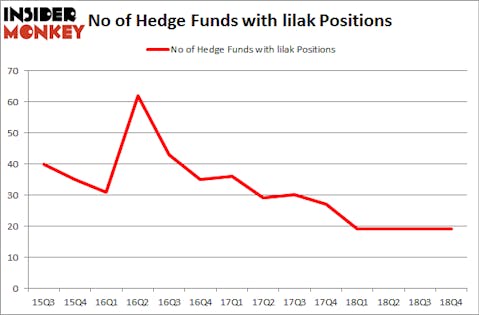

Hedge fund interest in Liberty Latin America Ltd. (NASDAQ:LILAK) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Ascendis Pharma A/S (NASDAQ:ASND), AllianceBernstein Holding LP (NYSE:AB), and LiveRamp Holdings, Inc. (NYSE:RAMP) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the new hedge fund action surrounding Liberty Latin America Ltd. (NASDAQ:LILAK).

Hedge fund activity in Liberty Latin America Ltd. (NASDAQ:LILAK)

At Q4’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. On the other hand, there were a total of 19 hedge funds with a bullish position in LILAK a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Liberty Latin America Ltd. (NASDAQ:LILAK) was held by Ashe Capital, which reported holding $85.8 million worth of stock at the end of September. It was followed by Fine Capital Partners with a $81.2 million position. Other investors bullish on the company included Two Creeks Capital Management, GoldenTree Asset Management, and Wallace R. Weitz & Co..

Judging by the fact that Liberty Latin America Ltd. (NASDAQ:LILAK) has experienced a decline in interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of hedgies that slashed their full holdings last quarter. Interestingly, John A. Levin’s Levin Capital Strategies said goodbye to the biggest position of all the hedgies monitored by Insider Monkey, totaling about $2.1 million in stock, and Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners was right behind this move, as the fund said goodbye to about $0.5 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Liberty Latin America Ltd. (NASDAQ:LILAK) but similarly valued. These stocks are Ascendis Pharma A/S (NASDAQ:ASND), AllianceBernstein Holding LP (NYSE:AB), LiveRamp Holdings, Inc. (NYSE:RAMP), and Kennedy-Wilson Holdings Inc (NYSE:KW). This group of stocks’ market valuations are closest to LILAK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASND | 26 | 1358060 | -1 |

| AB | 7 | 18133 | 1 |

| RAMP | 18 | 314152 | 3 |

| KW | 13 | 428350 | 1 |

| Average | 16 | 529674 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $530 million. That figure was $322 million in LILAK’s case. Ascendis Pharma A/S (NASDAQ:ASND) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 7 bullish hedge fund positions. Liberty Latin America Ltd. (NASDAQ:LILAK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on LILAK as the stock returned 38.8% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.