Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of LGI Homes Inc (NASDAQ:LGIH).

Is LGI Homes Inc (NASDAQ:LGIH) a buy here? The smart money is getting more optimistic. The number of bullish hedge fund bets improved by 2 lately. Our calculations also showed that LGIH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the fresh hedge fund action encompassing LGI Homes Inc (NASDAQ:LGIH).

How are hedge funds trading LGI Homes Inc (NASDAQ:LGIH)?

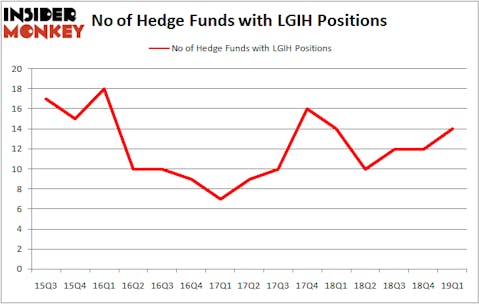

At Q1’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in LGIH over the last 15 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Capital Growth Management, managed by Ken Heebner, holds the most valuable position in LGI Homes Inc (NASDAQ:LGIH). Capital Growth Management has a $19.3 million position in the stock, comprising 1.2% of its 13F portfolio. Coming in second is DC Capital Partners, managed by Douglas Dethy, which holds a $18.1 million position; 13.2% of its 13F portfolio is allocated to the stock. Some other peers that are bullish encompass Chuck Royce’s Royce & Associates, Richard Driehaus’s Driehaus Capital and Phil Frohlich’s Prescott Group Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Driehaus Capital, managed by Richard Driehaus, assembled the biggest position in LGI Homes Inc (NASDAQ:LGIH). Driehaus Capital had $15.7 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $10.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as LGI Homes Inc (NASDAQ:LGIH) but similarly valued. These stocks are McGrath RentCorp (NASDAQ:MGRC), Synaptics Incorporated (NASDAQ:SYNA), S & T Bancorp Inc (NASDAQ:STBA), and Air Transport Services Group Inc. (NASDAQ:ATSG). This group of stocks’ market valuations match LGIH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGRC | 22 | 135815 | -1 |

| SYNA | 21 | 138905 | 6 |

| STBA | 4 | 4440 | -4 |

| ATSG | 18 | 209338 | 5 |

| Average | 16.25 | 122125 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $122 million. That figure was $116 million in LGIH’s case. McGrath RentCorp (NASDAQ:MGRC) is the most popular stock in this table. On the other hand S & T Bancorp Inc (NASDAQ:STBA) is the least popular one with only 4 bullish hedge fund positions. LGI Homes Inc (NASDAQ:LGIH) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on LGIH as the stock returned 19% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.