Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about LexinFintech Holdings Ltd. (NASDAQ:LX) in this article.

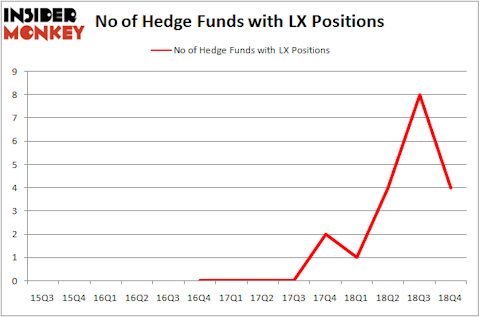

LexinFintech Holdings Ltd. (NASDAQ:LX) was in 4 hedge funds’ portfolios at the end of the fourth quarter of 2018. LX shareholders have witnessed a decrease in enthusiasm from smart money lately. There were 8 hedge funds in our database with LX positions at the end of the previous quarter. Our calculations also showed that LX isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are perceived as worthless, outdated financial vehicles of yesteryear. While there are greater than 8000 funds trading at present, Our experts look at the moguls of this club, approximately 750 funds. These investment experts oversee the majority of the smart money’s total asset base, and by tracking their first-class picks, Insider Monkey has identified many investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the fresh hedge fund action encompassing LexinFintech Holdings Ltd. (NASDAQ:LX).

What have hedge funds been doing with LexinFintech Holdings Ltd. (NASDAQ:LX)?

Heading into the first quarter of 2019, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -50% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LX over the last 14 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the most valuable position in LexinFintech Holdings Ltd. (NASDAQ:LX). Arrowstreet Capital has a $3.3 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Jim Simons of Renaissance Technologies, with a $0.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism contain Ken Griffin’s Citadel Investment Group, Matthew Hulsizer’s PEAK6 Capital Management and .

Judging by the fact that LexinFintech Holdings Ltd. (NASDAQ:LX) has faced falling interest from the aggregate hedge fund industry, we can see that there exists a select few hedgies who sold off their full holdings by the end of the third quarter. At the top of the heap, David Halpert’s Prince Street Capital Management sold off the largest stake of the 700 funds tracked by Insider Monkey, worth an estimated $3.8 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund cut about $0.9 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to LexinFintech Holdings Ltd. (NASDAQ:LX). These stocks are Cango Inc. (NYSE:CANG), Federal Signal Corporation (NYSE:FSS), Cardtronics plc (NASDAQ:CATM), and First Busey Corporation (NASDAQ:BUSE). This group of stocks’ market valuations are closest to LX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CANG | 2 | 814 | 0 |

| FSS | 22 | 70746 | 4 |

| CATM | 18 | 291296 | 0 |

| BUSE | 12 | 33593 | -2 |

| Average | 13.5 | 99112 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $4 million in LX’s case. Federal Signal Corporation (NYSE:FSS) is the most popular stock in this table. On the other hand Cango Inc. (NYSE:CANG) is the least popular one with only 2 bullish hedge fund positions. LexinFintech Holdings Ltd. (NASDAQ:LX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on LX as the stock returned 83.9% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.