Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Laureate Education, Inc. (NASDAQ:LAUR) and see how the stock is affected by the recent hedge fund activity.

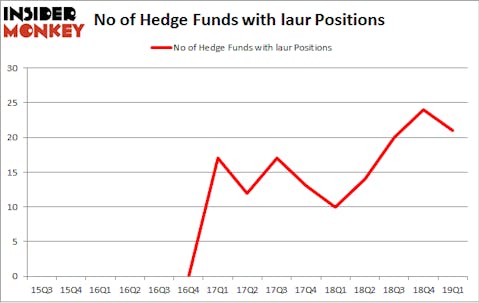

Is Laureate Education, Inc. (NASDAQ:LAUR) a cheap investment now? The best stock pickers are turning less bullish. The number of bullish hedge fund positions retreated by 3 lately. Our calculations also showed that laur isn’t among the 30 most popular stocks among hedge funds. LAUR was in 21 hedge funds’ portfolios at the end of March. There were 24 hedge funds in our database with LAUR positions at the end of the previous quarter.

To the average investor there are numerous gauges market participants employ to value publicly traded companies. A pair of the most under-the-radar gauges are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outclass the broader indices by a healthy amount (see the details here).

Let’s go over the fresh hedge fund action surrounding Laureate Education, Inc. (NASDAQ:LAUR).

How are hedge funds trading Laureate Education, Inc. (NASDAQ:LAUR)?

At the end of the first quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in LAUR over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Gabriel Plotkin’s Melvin Capital Management has the biggest position in Laureate Education, Inc. (NASDAQ:LAUR), worth close to $99.2 million, accounting for 1.2% of its total 13F portfolio. Coming in second is Joel Ramin of 12 West Capital Management, with a $54.9 million position; 4.5% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism consist of Genevieve Kahr’s Ailanthus Capital Management, Jeffrey Tannenbaum’s Fir Tree and Jared Nussbaum’s Nut Tree Capital.

Since Laureate Education, Inc. (NASDAQ:LAUR) has experienced declining sentiment from hedge fund managers, logic holds that there exists a select few money managers that elected to cut their entire stakes in the third quarter. At the top of the heap, David Halpert’s Prince Street Capital Management said goodbye to the largest position of the 700 funds followed by Insider Monkey, comprising about $12.4 million in stock, and Minhua Zhang’s Weld Capital Management was right behind this move, as the fund said goodbye to about $1.2 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Laureate Education, Inc. (NASDAQ:LAUR) but similarly valued. We will take a look at Investors Bancorp, Inc. (NASDAQ:ISBC), ASGN Incorporated (NYSE:ASGN), Turquoise Hill Resources Ltd (NYSE:TRQ), and Lions Gate Entertainment Corporation (NYSE:LGF-B). All of these stocks’ market caps match LAUR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ISBC | 24 | 658094 | -3 |

| ASGN | 23 | 171702 | 2 |

| TRQ | 17 | 928990 | 1 |

| LGF-B | 16 | 285528 | -3 |

| Average | 20 | 511079 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $511 million. That figure was $277 million in LAUR’s case. Investors Bancorp, Inc. (NASDAQ:ISBC) is the most popular stock in this table. On the other hand Lions Gate Entertainment Corporation (NYSE:LGF-B) is the least popular one with only 16 bullish hedge fund positions. Laureate Education, Inc. (NASDAQ:LAUR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on LAUR as the stock returned 10.2% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.