Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

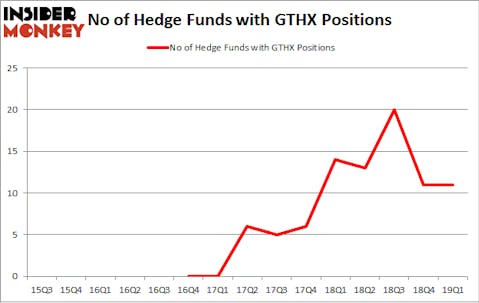

G1 Therapeutics, Inc. (NASDAQ:GTHX) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as RadNet Inc. (NASDAQ:RDNT), Sunlands Technology Group (NYSE:STG), and Flushing Financial Corporation (NASDAQ:FFIC) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the latest hedge fund action surrounding G1 Therapeutics, Inc. (NASDAQ:GTHX).

How have hedgies been trading G1 Therapeutics, Inc. (NASDAQ:GTHX)?

Heading into the second quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GTHX over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, RA Capital Management was the largest shareholder of G1 Therapeutics, Inc. (NASDAQ:GTHX), with a stake worth $6 million reported as of the end of March. Trailing RA Capital Management was Citadel Investment Group, which amassed a stake valued at $4.6 million. Millennium Management, Baker Bros. Advisors, and Marshall Wace LLP were also very fond of the stock, giving the stock large weights in their portfolios.

Because G1 Therapeutics, Inc. (NASDAQ:GTHX) has faced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of hedge funds who sold off their positions entirely in the third quarter. At the top of the heap, Bihua Chen’s Cormorant Asset Management cut the biggest stake of the 700 funds watched by Insider Monkey, comprising about $19 million in stock, and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management was right behind this move, as the fund sold off about $1.9 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as G1 Therapeutics, Inc. (NASDAQ:GTHX) but similarly valued. We will take a look at RadNet Inc. (NASDAQ:RDNT), Sunlands Technology Group (NYSE:STG), Flushing Financial Corporation (NASDAQ:FFIC), and Merchants Bancorp (NASDAQ:MBIN). This group of stocks’ market values resemble GTHX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDNT | 14 | 84001 | 0 |

| STG | 2 | 1120 | 0 |

| FFIC | 8 | 42537 | 1 |

| MBIN | 3 | 1199 | -1 |

| Average | 6.75 | 32214 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $20 million in GTHX’s case. RadNet Inc. (NASDAQ:RDNT) is the most popular stock in this table. On the other hand Sunlands Technology Group (NYSE:STG) is the least popular one with only 2 bullish hedge fund positions. G1 Therapeutics, Inc. (NASDAQ:GTHX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on GTHX as the stock returned 58.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.