We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of FactSet Research Systems Inc. (NYSE:FDS) based on that data.

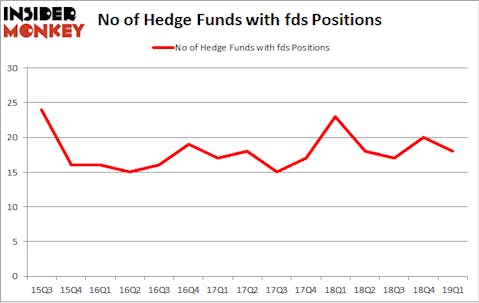

Is FactSet Research Systems Inc. (NYSE:FDS) going to take off soon? Prominent investors are taking a bearish view. The number of long hedge fund positions shrunk by 2 lately. Our calculations also showed that fds isn’t among the 30 most popular stocks among hedge funds. FDS was in 18 hedge funds’ portfolios at the end of March. There were 20 hedge funds in our database with FDS positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action encompassing FactSet Research Systems Inc. (NYSE:FDS).

Hedge fund activity in FactSet Research Systems Inc. (NYSE:FDS)

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the fourth quarter of 2018. By comparison, 23 hedge funds held shares or bullish call options in FDS a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of FactSet Research Systems Inc. (NYSE:FDS), with a stake worth $146.9 million reported as of the end of March. Trailing Renaissance Technologies was Markel Gayner Asset Management, which amassed a stake valued at $28.8 million. Echo Street Capital Management, Millennium Management, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Since FactSet Research Systems Inc. (NYSE:FDS) has witnessed declining sentiment from the aggregate hedge fund industry, it’s safe to say that there is a sect of fund managers who sold off their full holdings by the end of the third quarter. Intriguingly, Peter Seuss’s Prana Capital Management sold off the biggest position of all the hedgies tracked by Insider Monkey, valued at about $11.4 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also cut its stock, about $7.4 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to FactSet Research Systems Inc. (NYSE:FDS). These stocks are Tapestry, Inc. (NYSE:TPR), Packaging Corporation Of America (NYSE:PKG), PG&E Corporation (NYSE:PCG), and Erie Indemnity Company (NASDAQ:ERIE). This group of stocks’ market valuations resemble FDS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPR | 29 | 372102 | -9 |

| PKG | 26 | 212243 | -7 |

| PCG | 72 | 4787090 | 14 |

| ERIE | 17 | 98634 | 6 |

| Average | 36 | 1367517 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $1368 million. That figure was $251 million in FDS’s case. PG&E Corporation (NYSE:PCG) is the most popular stock in this table. On the other hand Erie Indemnity Company (NASDAQ:ERIE) is the least popular one with only 17 bullish hedge fund positions. FactSet Research Systems Inc. (NYSE:FDS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on FDS as the stock returned 12.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.