The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Arconic Inc. (NYSE:ARNC), and what that likely means for the prospects of the company and its stock.

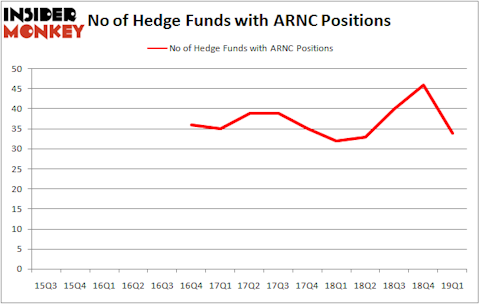

Is Arconic Inc. (NYSE:ARNC) a buy right now? The smart money is taking a bearish view. The number of long hedge fund positions dropped by 12 recently. Our calculations also showed that ARNC isn’t among the 30 most popular stocks among hedge funds. ARNC was in 34 hedge funds’ portfolios at the end of March. There were 46 hedge funds in our database with ARNC holdings at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Arnaud Ajdler Engine Capital

We’re going to take a look at the new hedge fund action regarding Arconic Inc. (NYSE:ARNC).

What does the smart money think about Arconic Inc. (NYSE:ARNC)?

At the end of the first quarter, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of -26% from the fourth quarter of 2018. By comparison, 32 hedge funds held shares or bullish call options in ARNC a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Arconic Inc. (NYSE:ARNC) was held by Elliott Management, which reported holding $991.9 million worth of stock at the end of March. It was followed by First Pacific Advisors LLC with a $503.2 million position. Other investors bullish on the company included Orbis Investment Management, Canyon Capital Advisors, and Kensico Capital.

Judging by the fact that Arconic Inc. (NYSE:ARNC) has experienced a decline in interest from the aggregate hedge fund industry, we can see that there was a specific group of money managers that decided to sell off their entire stakes in the third quarter. At the top of the heap, Michael Hintze’s CQS Cayman LP dropped the biggest position of the “upper crust” of funds followed by Insider Monkey, comprising about $10.7 million in call options. Didric Cederholm’s fund, Lion Point, also said goodbye to its call options, about $8.9 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 12 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Arconic Inc. (NYSE:ARNC) but similarly valued. These stocks are EQM Midstream Partners LP (NYSE:EQM), PVH Corp (NYSE:PVH), Zendesk Inc (NYSE:ZEN), and MGM Growth Properties LLC (NYSE:MGP). This group of stocks’ market caps are closest to ARNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQM | 8 | 65494 | 0 |

| PVH | 31 | 1298477 | -4 |

| ZEN | 53 | 2095311 | 0 |

| MGP | 17 | 315394 | 5 |

| Average | 27.25 | 943669 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $944 million. That figure was $2520 million in ARNC’s case. Zendesk Inc (NYSE:ZEN) is the most popular stock in this table. On the other hand EQM Midstream Partners LP (NYSE:EQM) is the least popular one with only 8 bullish hedge fund positions. Arconic Inc. (NYSE:ARNC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ARNC as the stock returned 15.2% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.