Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Arch Capital Group Ltd. (NASDAQ:ACGL).

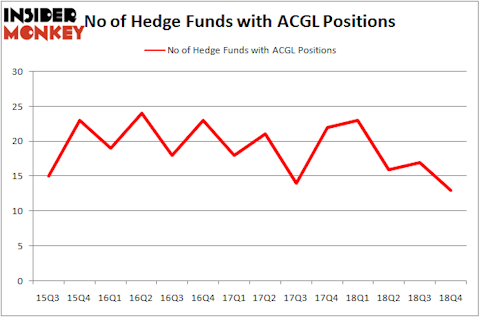

Arch Capital Group Ltd. (NASDAQ:ACGL) was in 13 hedge funds’ portfolios at the end of December. ACGL investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. There were 17 hedge funds in our database with ACGL positions at the end of the previous quarter. Our calculations also showed that ACGL isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are many signals investors have at their disposal to appraise their stock investments. Two of the most underrated signals are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top investment managers can outclass the market by a significant amount (see the details here).

We’re going to take a look at the latest hedge fund action regarding Arch Capital Group Ltd. (NASDAQ:ACGL).

Hedge fund activity in Arch Capital Group Ltd. (NASDAQ:ACGL)

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ACGL over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, FPR Partners held the most valuable stake in Arch Capital Group Ltd. (NASDAQ:ACGL), which was worth $470.4 million at the end of the third quarter. On the second spot was Polar Capital which amassed $205.4 million worth of shares. Moreover, Renaissance Technologies, D E Shaw, and Two Sigma Advisors were also bullish on Arch Capital Group Ltd. (NASDAQ:ACGL), allocating a large percentage of their portfolios to this stock.

Seeing as Arch Capital Group Ltd. (NASDAQ:ACGL) has experienced declining sentiment from hedge fund managers, it’s safe to say that there were a few hedge funds who were dropping their full holdings last quarter. It’s worth mentioning that Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital cut the biggest position of the “upper crust” of funds monitored by Insider Monkey, valued at about $3.5 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also said goodbye to its stock, about $2.4 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 4 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Arch Capital Group Ltd. (NASDAQ:ACGL) but similarly valued. We will take a look at Universal Health Services, Inc. (NYSE:UHS), Martin Marietta Materials, Inc. (NYSE:MLM), CarMax Inc (NYSE:KMX), and Lamb Weston Holdings, Inc. (NYSE:LW). All of these stocks’ market caps match ACGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UHS | 28 | 735233 | -4 |

| MLM | 34 | 1960173 | 1 |

| KMX | 28 | 1430636 | -3 |

| LW | 32 | 895466 | -2 |

| Average | 30.5 | 1255377 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $1255 million. That figure was $943 million in ACGL’s case. Martin Marietta Materials, Inc. (NYSE:MLM) is the most popular stock in this table. On the other hand Universal Health Services, Inc. (NYSE:UHS) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Arch Capital Group Ltd. (NASDAQ:ACGL) is even less popular than UHS. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on ACGL as the stock returned 23% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.