We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of AppFolio Inc (NASDAQ:APPF).

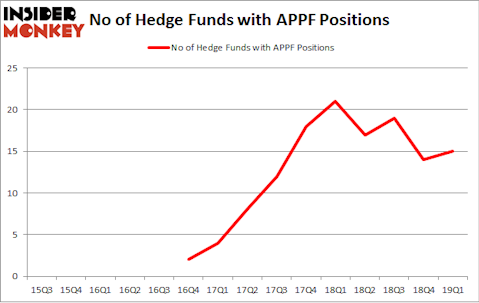

AppFolio Inc (NASDAQ:APPF) was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. APPF has experienced an increase in enthusiasm from smart money recently. There were 14 hedge funds in our database with APPF positions at the end of the previous quarter. Our calculations also showed that appf isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a multitude of signals shareholders use to size up stocks. A couple of the most underrated signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the broader indices by a healthy amount (see the details here).

Cliff Asness of AQR Capital Management

Let’s analyze the key hedge fund action surrounding AppFolio Inc (NASDAQ:APPF).

How have hedgies been trading AppFolio Inc (NASDAQ:APPF)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in APPF over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Ashe Capital was the largest shareholder of AppFolio Inc (NASDAQ:APPF), with a stake worth $127.1 million reported as of the end of March. Trailing Ashe Capital was Renaissance Technologies, which amassed a stake valued at $35.6 million. Echo Street Capital Management, Arrowstreet Capital, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have been driving this bullishness. PEAK6 Capital Management, managed by Matthew Hulsizer, assembled the largest call position in AppFolio Inc (NASDAQ:APPF). PEAK6 Capital Management had $1.1 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also initiated a $0.6 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Ken Griffin’s Citadel Investment Group, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s also examine hedge fund activity in other stocks similar to AppFolio Inc (NASDAQ:APPF). We will take a look at KBR, Inc. (NYSE:KBR), PDC Energy Inc (NASDAQ:PDCE), National General Holdings Corp (NASDAQ:NGHC), and Simpson Manufacturing Co, Inc. (NYSE:SSD). This group of stocks’ market values are closest to APPF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KBR | 20 | 362648 | -6 |

| PDCE | 14 | 212661 | -2 |

| NGHC | 18 | 224301 | 2 |

| SSD | 19 | 198545 | 2 |

| Average | 17.75 | 249539 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $250 million. That figure was $231 million in APPF’s case. KBR, Inc. (NYSE:KBR) is the most popular stock in this table. On the other hand PDC Energy Inc (NASDAQ:PDCE) is the least popular one with only 14 bullish hedge fund positions. AppFolio Inc (NASDAQ:APPF) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on APPF as the stock returned 34.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.