We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Baidu, Inc. (NASDAQ:BIDU) and determine whether hedge funds skillfully traded this stock.

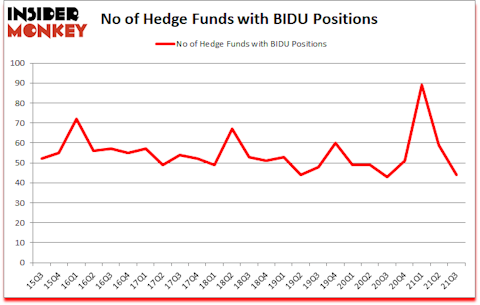

Is Baidu, Inc. (NASDAQ:BIDU) a buy right now? Investors who are in the know were becoming less hopeful. The number of bullish hedge fund positions decreased by 15 recently. Baidu, Inc. (NASDAQ:BIDU) was in 44 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 89. Our calculations also showed that BIDU isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). There were 59 hedge funds in our database with BIDU holdings at the end of June.

Bruce Kovner of Caxton Associates LP

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to check out the latest hedge fund action encompassing Baidu, Inc. (NASDAQ:BIDU).

Do Hedge Funds Think BIDU Is A Good Stock To Buy Now?

At third quarter’s end, a total of 44 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from one quarter earlier. By comparison, 43 hedge funds held shares or bullish call options in BIDU a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Baidu, Inc. (NASDAQ:BIDU), which was worth $507.1 million at the end of the third quarter. On the second spot was Ariel Investments which amassed $399.8 million worth of shares. Two Sigma Advisors, Citadel Investment Group, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Oasis Management allocated the biggest weight to Baidu, Inc. (NASDAQ:BIDU), around 9.7% of its 13F portfolio. Keywise Capital Management is also relatively very bullish on the stock, setting aside 9.34 percent of its 13F equity portfolio to BIDU.

Due to the fact that Baidu, Inc. (NASDAQ:BIDU) has experienced falling interest from the smart money, we can see that there lies a certain “tier” of money managers that slashed their entire stakes last quarter. At the top of the heap, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC cut the largest stake of the 750 funds tracked by Insider Monkey, worth an estimated $123.2 million in stock. Bruce Kovner’s fund, Caxton Associates LP, also sold off its stock, about $85.2 million worth. These transactions are important to note, as total hedge fund interest was cut by 15 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Baidu, Inc. (NASDAQ:BIDU). We will take a look at Honda Motor Co Ltd (NYSE:HMC), DexCom, Inc. (NASDAQ:DXCM), The Progressive Corporation (NYSE:PGR), Metlife Inc (NYSE:MET), IDEXX Laboratories, Inc. (NASDAQ:IDXX), Align Technology, Inc. (NASDAQ:ALGN), and Lululemon Athletica inc. (NASDAQ:LULU). This group of stocks’ market valuations are similar to BIDU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMC | 12 | 338639 | 2 |

| DXCM | 53 | 1781583 | 4 |

| PGR | 47 | 1574950 | 3 |

| MET | 39 | 1145473 | -2 |

| IDXX | 43 | 3698749 | 4 |

| ALGN | 49 | 2262912 | -8 |

| LULU | 41 | 709432 | -5 |

| Average | 40.6 | 1644534 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.6 hedge funds with bullish positions and the average amount invested in these stocks was $1645 million. That figure was $2005 million in BIDU’s case. DexCom, Inc. (NASDAQ:DXCM) is the most popular stock in this table. On the other hand Honda Motor Co Ltd (NYSE:HMC) is the least popular one with only 12 bullish hedge fund positions. Baidu, Inc. (NASDAQ:BIDU) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BIDU is 43.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still managed to beat the market by another 3.6 percentage points. Hedge funds were somewhat right about betting on BIDU as the stock returned 3.9% since the end of September (through January 31st) and outperformed the top 5 hedge fund stocks but not the market. This is a rare phenomenon as top hedge fund stocks usually beat the market over the long-term.

Follow Baidu Inc (NASDAQ:BIDU)

Follow Baidu Inc (NASDAQ:BIDU)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Biggest Bitcoin Predictions in 2021

- 12 Best EV Stocks to Invest In

- 10 Cheap Chinese Stocks to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.