Dell Inc. (NASDAQ:DELL) had difficulty with beating earnings estimates this past quarter. The company was able to beat analyst estimate for revenues but missed on earnings. In an environment of declining PC sales, the company was able to off-set this decline with growth in revenue from its service segments.

The company reported a 5% decline in revenues from its products division (desktop computers, laptops, tablets, printers, and anything else hardware related). The company, on the other hand, reported a 6% growth rate in revenues from its services segment. The total revenue declined by 2% in the most recent quarter which was driven by falling computer demand.

The company reported a 73% decline in operating income with an 81% decline in year-over-year earnings per share. The decline in operating income and earnings is two-fold. First the company reported a decline in sales. But following that the company also reported that the cost of running the business increased by 12%. The increase in costs led to ultra-thin profit margins of 1.2% for the first quarter of 2013.

What to expect from Dell going forward

There has been an on-going debate over whether or not Michael Dell can pull-off a leveraged buy-out of his own company for $13.65 per share. The likelihood of that deal passing is slim as institutional investors like Southeastern Asset Management Inc believe that the stock is worth substantially more than $13.65 per share. Southeastern Asset Management Inc believes that Dell Inc. (NASDAQ:DELL)’s valuation should be at around $23.72 per share.

Now, I’m not saying Southeastern Asset Management is wrong, but the valuation seems a little rich. A full break-down of the valuation analysis can be found on its website. Upon close examination, Southeastern Asset Management is making a very good point. It’s getting ripped off, which is why Southeastern Asset Management Inc is proposing for Dell to offer a $12 special dividend to shareholders while keeping the stock publicly traded (I’ll have a full article written on this later on today).

After looking over the Southeastern Asset Management’s analysis of the financial valuation of the company. It is highly unlikely that Michael Dell will get away with buying the company out at $13.65 per share. However, the alternative deal proposed by Southeastern Asset Management is likely to keep investors on the fence up until the August 2nd shareholder meeting.

What’s going on in the desktop and laptop space?

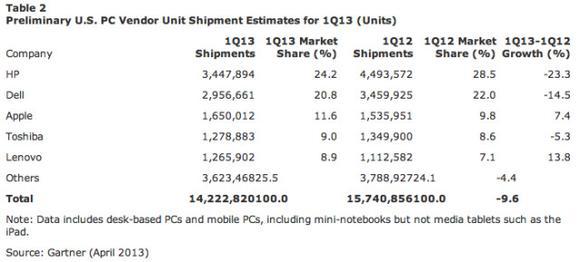

The decline in desktop shipments wasn’t completely due to the decline in demand for computers. When closely examining the figure below we can come up with an idea as to what actually happened.

Looking closely at the data it seems that Lenovo and Apple Inc. (NASDAQ:AAPL) were able to gain both in terms of market share and growth. Meanwhile, Hewlett Packard and Dell reported declines from their desktop and laptop divisions. Investors are hoping that the Windows 8 will be able to off-set some of the decline in desktop shipment sales as consumers adopt new products.