Even a small share of the deep learning market will mean huge revenue and could drive Advanced Micro Devices, Inc. (NASDAQ:AMD) stock higher in 2017.

Advanced Micro Devices, Inc. (NASDAQ:AMD) hasn’t been a prominent name in the fields of deep learning and artificial intelligence. In fact, up until a few months ago, its presence in the space was practically non-existent and almost all of the market belonged to NVIDIA Corporation (NASDAQ:NVDA). But times are changing fast and things won’t necessarily stay the same forever. There is a reason to believe that AMD’s upcoming launches and strategic investments in key areas could position it as a critical player in this rapidly growing segment and drive its overall growth. Let’s take a closer look.

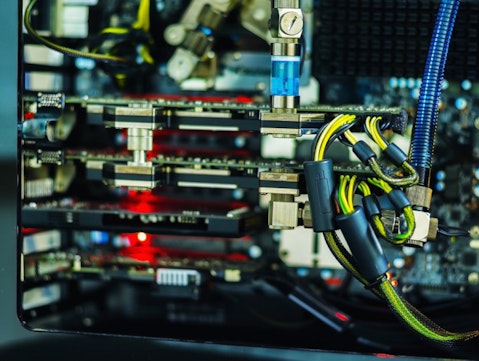

spacedrone808/Shutterstock.com

How The Market Is Shaping Up

Let me start by first emphasizing the importance of the deep learning space for AMD. The segment is still in its nascent stages with a small total addressable market. However, it is expected to grow at a blistering pace over the next few years. A recent report by BCC Research suggests that the hardware-based market size for the deep learning industry could expand from $6.4 billion in 2014 to $15.3 billion by 2019. This might include sales of different kinds of computing hardware that would go into setting up these computing clusters, but we have to realize that it’s an impressive CAGR of 19.7% projected for the next three years.

You see, it was only with Google’s decision to use AMD’s cards in its cloud-based artificial intelligence platform earlier this year, that we started to see a demand for the chipmaker’s offerings in the world of deep learning or neural mapping. Prior to that, AMD’s presence in the field was practically zero. So AMD doesn’t have the law of large numbers going against it at the moment. Its market share gains, even small ones, in the deep learning space have the potential of boosting AMD’s revenues by a significant margin.

Also Read: Is AMD Stock Set To Skyrocket After Ryzen Release?

To put things in perspective, if AMD manages to corner even 5% of the deep learning hardware industry, its revenues from the segment would aggregate to around $765 million. This figure may not mean much in isolation. To put things in context, the aforementioned increment revenue from the deep learning segment would singlehandedly add about 19% to AMD’s top-line. So the deep learning hardware space could become a significant growth driver for AMD going forward, that is, if the chipmaker plays its cards right.

It’s Probably Not All That Easy Though For AMD

With the rosy projections out of the way, it’s time to look at the harsh reality. Both NVIDIA Corporation (NASDAQ:NVDA) and AMD have been making GPUs for more than a decade now, and yet, Nvidia has grown to dominate the artificial intelligence space, while AMD hasn’t been able to make a place in the segment up until a few months ago. Why do you think this was the case?

Well, there is nothing wrong with AMD’s GPUs. In fact, in some cases, they fare better than Nvidia offerings. But, the fact of the matter is that hardware is just one aspect of the overall deep learning exercise. Your software needs to communicate with your hardware efficiently to fully utilize the available resources. Ecosystems, libraries and the knowledge base make a lot of difference, which is exactly where Nvidia has excelled and outshone AMD.

Most of the neural networking code makes use of Nvidia’s CUDA libraries. AMD has made its OpenCL ecosystem available to developers but it’s reportedly not supported as extensively as cuDNN. More to the point, Nvidia GPGPUs (general purpose GPUs) support both OpenCL and CUDA frameworks while AMD cards support only the open source OpenCL framework. This means that developers are better incentivized to build programs for Nvidia’s popular CUDA.

The problem for Advanced Micro Devices, Inc. (NASDAQ:AMD) doesn’t end there. Nvidia has a vast knowledge base that not only provides static help content but also extends support in the form of courses and workshops to get developers started from scratch. So the issue isn’t based on hardware. It is, in fact, due to the aforementioned software and ecosystem related issues that developers have been forced to mostly build CUDA software up until now. (Also See: Why AMD Stock Looks Unstoppable For Now)

Follow Advanced Micro Devices Inc (NASDAQ:AMD)

Follow Advanced Micro Devices Inc (NASDAQ:AMD)

Receive real-time insider trading and news alerts

AMD Now Has A Plan To Take On Nvidia

There was a clear problem of cross platform support. If developers built software for CUDA, then it won’t necessarily run on OpenCL. Similarly, code built for OpenCL won’t run on CUDA. So developers built software for the more popular CUDA framework which limited deep learning programs to Nvidia’s ecosystem.

This was a big issue and needed to be addressed. This is where a graphics startup Otoy came into picture. The firm basically reverse engineered CUDA framework and was able to successfully port programs built for Nvidia cards, over to graphics engines built by ARM, Intel and AMD. Shortly after, we saw apps built exclusively for NVIDIA Corporation (NASDAQ:NVDA), running smoothly on AMD cards. So it was a big benefit for AMD.

Follow Nvidia Corp (NASDAQ:NVDA)

Follow Nvidia Corp (NASDAQ:NVDA)

Receive real-time insider trading and news alerts

In order to take its interaction with the CUDA architecture a bit further, AMD breathed life into it’s Boltzman initiative earlier this year. You can read about it in detail here (1) but the crux of it all is that AMD is now able to port 99.6% of CUDA code over to its OpenCL framework. And the entire conversion process is automatic.

This basically means that developers don’t have to work hard to build a separate code for AMD chips. They just have to port it using an automatic conversion tool and the AMD ecosystem would open up to them. Meanwhile, the ported apps immediately enhance AMD’s appeal in the deep learning space. So it’s a massive win-win situation for both AMD and developers. Both parties get to benefit with minimal human intervention.

What Lies Ahead For AMD?

Advanced Micro Devices, Inc. (NASDAQ:AMD) has addressed the porting issue and now CUDA apps can run on its GPGPUs. This essentially means that enterprises looking to invest in deep learning setups can now source the hardware from both Nvidia and AMD (meaning more revenue for AMD?). As high-performance Vega cards get released next year, I believe more enterprises would strike sourcing deals with AMD for their deep learning machines.

Also Read: Why The Google Deal May Be The First Of Many For Advanced Micro Devices, Inc.

It is these reasons that lead me to believe that AMD can now become a contender in the deep learning segment. It won’t be able to replace CUDA anytime soon, but at least this way, it has put a step forward and gotten in on a rapidly growing market. Even small market share gains in the segment could drive AMD’s growth going forward.

The article Deep Learning To Drive Huge Growth For Advanced Micro Devices Inc (AMD) originally appeared on amigobulls.com. Watch our analysis video on AMD (2)

Amigobulls.com – Watch, Analyze, Invest. Why spend hours putting together numbers you can get in minutes, in one simple video? Our ‘Robo Advisor’ videos give you every number that matters, in 1 minute. Find insightful articles with ideas on investing, top stock picks that outperform the markets, personalized portfolio analysis videos and a whole lot more. Amigobulls.com – Your Friend On Wall Street.

Additional Links:

(1) http://www.anandtech.com/show/10831/amd-sc16-rocm-13-released-boltzmann-realized?ref=il