Cummins (NYSE: CMI) is an American Global Corporation that designs, manufactures, distributes filtration, makes and sells engines, and power generation products. It services alternative and diesel fuel engines. Cummins is known for its ‘Superior Truck Engine’ that possess the horsepower and torque just like that of a work truck, that can easily tow a massive load.

Recently, the company celebrated “Cummins Hydrogen Day”. Being an advocate in making people’s lives better, the company pledges to regularly innovate for their customers’ success. As their contribution to the world and as their participation in the modern-world ‘hydrogen economy’, Cummins continues to develop its fuel cell capabilities as it did more than 20 years ago. It remains committed to help bring a future that includes clean diesel, natural gas, electrified power, fuel cell technology, and alternative fuels to lessen the world’s carbon footprint.

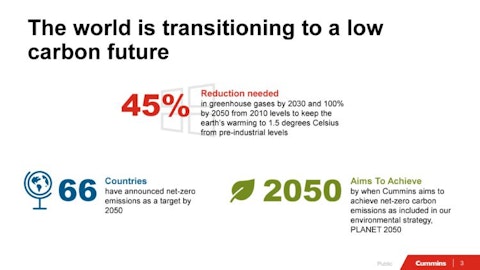

The world is now transitioning to a low carbon future. In order to keep the earth’s warming to 1.5 °C, we need a 45% reduction in greenhouse gases by 2030 and 100% by 2050. In their effort to reduce the world’s carbon footprint, Cummins, as included in their ‘PLANET 2050’ environmental strategy, aims to achieve a ‘net-zero’ carbon emission in the year 2050 and as of writing, there are already 66 countries that have committed to this mission.

As per Cummins, ‘Hydrogen will play a critical role’ in lowering global emissions of carbon since Hydrogen is versatile, energy-dense, abundant, renewable, and most especially, it’s good for the environment.

In their Hydrogen Production, Cummins will be using PEM and Alkaline technologies through an on-site and on-demand generation that is capable to produce 10 tons of hydrogen per day.

Talking about their Hydrogen Dispensing and Storage facility, Cummins have already constructed 350 to 700 bar stations and NPROXX gas storage vessels that require easy integration with on-site generation solutions.

The company’s fuel cell stack and module are low cost but with high fuel cell modules. They were able to integrate the balance of the plant and was able to come up with a multi-module system for the widest range (kW-MW).

Based on the 3.5GW of Industry Electrolyzer sales, the company’s Cummins Electrolyzer business expects a $400 million revenue in the year 2025 and to provide 100 green trains powered by its fuel cell systems within the same year.

Just so you know, 1 kilogram of hydrogen is equivalent to 3 kilograms of diesel in terms of energy. Cummins’ Electrolyzer Efficiency is composed of Alkaline(55%-70%), Proton Exchange Membrane or PEM(65%-80%), and Solid Oxide(75%-90%). Meanwhile, its system efficiency is made up of PEM Fuel Cell(60%), Solid Oxide Fuel Cell(80%), Diesel Engine(50%), and Natural Gas Engine(35%-37%).

According to Cummins, renewable energy costs around $0.05-$0.10 per kWh. In order to produce 1kg of Hydrogen, there must be around 50kWh electrolysis. Roughly around $2.50-$5.00 worth of electricity is required to produce 1kg of hydrogen. On the other hand, the PEM electrolyzer costs $1 million per MegaWatt and equates to about $0.60 per kg of hydrogen. Approximately $3.10-$5.60 per kilogram is needed for the pre-distributed cost of hydrogen and an additional $10 per kilogram for the distribution costs. However, if the energy cost will be lowered to $0.05 per kWh and Capex costs by 50%, this will discount the pre-distributed cost to just around $2-$3 per kg.

This clean energy can be used in the production of steel and as a substitute for diesel engines. As of the moment, the current production of Hydrogen today is 70 million tons. Steel production is estimated to require 47-67 million tons of hydrogen which will roughly cost $300 billion at current prices. Replacing the diesel engines will need around 500 million tons of hydrogen, which costs $2.5 trillion at recent prices.

Cummins

In conclusion, Cummins aims to globally produce and represent 2.5% of sales of the heavy-duty truck market, 10% of sales of the bus market, and 10% of sales of the train market by the year 2030.