The brave new world of cryptocurrency offers a lot of potential, even for small investors. It’s exciting!

The idea itself is pretty simple – you acquire these digital currencies as assets, and trade them, or save them up for the future, to beat inflation, to grow your money over time – to “win” at trading.

However, as with any other kind of finance, there’s a lot of other complexity that applies behind the scenes. First, you have to understand how these assets are valued. But just as important – you have to deal with the jumble of rules, regulations and red tape involved in crypto taxation.

Crypto taxation is a beast – even national regulators have a hard time finding the pulse, and so many smaller investors just feel hopelessly unmoored when it comes to documenting anything from cost basis to an adjusted final rate.

As any small business owner knows, it’s hard enough to produce annual filings for businesses that just use the dollar or some other fiat currency. When you introduce cryptocurrency, you compound that complexity significantly.

For example let’s take Joe, an adventurous investor who got interested in cryptocurrency early on and made a mint with Bitcoin. He got in before the $20,000 high water mark, and so he tripled his money quickly – to the massive envy of all of his friends and relations.

Joe then got interested in altcoins, and wanted to distribute his winnings into various different types of coins. It’s reasonable to want to diversify, since many of these new digital assets end up in Davy Jones’ Locker.

But Joe soon found that the complexity was getting the better of him. He started to send himself emails with tax rates in the subject line. He tried to use Evernote to remind him of where his wallets were. As tech journalists are pointing out right and left, wallet loss is a real thing! You want to keep your crypto assets off of hot exchanges to prevent theft – but then a cold storage device can get mislaid very easily.

It’s tempting to think that you can keep track of crypto taxes and more with a spreadsheet or a productivity tool like Evernote. But in reality, this is kind of the equivalent of making reams of post-it notes for yourself – you get confused, and then you get super confused…

After wrangling with this kind of system for over a year, Joe threw in the towel and went to a CPA who advised him to utilize professional services. The accounting office used a sophisticated crypto tracking structural program – because that CPA was worth his salt and quickly started to understand the coin landscape. After dealing with only three client portfolios that held crypto assets, the CPA signed up for a tracking tool, as a way to not go thoroughly insane.

Doing It Right

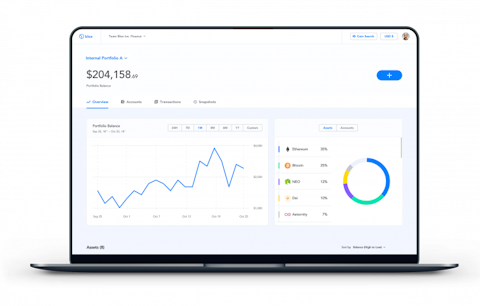

What does that look like? Take a look at cryptocurrency tracking tool Blox.

Here you have a company that has produced various crypto tracking tools for individuals and businesses. You have a dedicated API with a structure that’s transparent, in order to provide insight into cryptocurrency dealings. You have tools that reveal cost basis – and a real-time dashboard with balances, analytics, historical data and asset performance information. Investors can easily see:

- What they’re holding

- What projected tax burdens look like

- What regs apply

- What the industry context is

That’s just part of the utility of an award-winning crypto tracking platform.

Another great feature links wallets and exchange accounts – remember that wallet loss problem? Auto tracking takes care of that quite well. On the other hand, writing yourself notes is almost bound to fail.

Blox serves accounting firms and investors, miners and executives, asset managers and VCs. If an investor doesn’t have a CPA, the platform will help her to go the distance alone. If there’s a team involved, Blox sets up seamless data sharing.

Any business, really, runs on the flow of information. So having a framework for identifying and handling crypto assets is a vital part of the “crypto biz.” In addition, it’s important to have audit capability, for various reasons including risk mitigation. Blox has an audit trail with the ability to track transactions back to their roots, making fraud detection, KYC, and other aspects of fintech management effective. Users can also attach supporting documents to “make a whole file folder” – and then you don’t have to keep hunting for a particular doc when you’re in a given asset discovery process.

Seasoned investors who have dealt with crypto would mostly agree- skip the DIY process. If you have to go without CPA support, have a winning crypto tracking platform on your side.