Crosslink Capital is a San Francisco-based hedge fund founded by Michael Stark and Seymour Franklin Kaufman thirty years ago. Michael Stark is the fund’s portfolio manager and a supervisor of all investment-related activities of the fund. He holds a M.B.A. with honors and Distinction from the University of Michigan and a B.S. in Engineering from the Northwestern University. Prior to co-founding Crosslink Capital, Stark started off at Intel Corporation’s strategic planning group, and later worked as a Director of Research and Equity Analyst in charge of software and semiconductor businesses at Robertson Stephens. This is why it is no surprise that Crosslink Capital is focused on small- and mid-cap technology-related companies. The fund invests in newly established projects and businesses as well, helping their development and expansion. Crosslink Capital employs long/short strategy, with a tendency to hold a board seat in companies they invest in.

Throughout the last period, the fund was returning positively and steadily with exception of one-year loss. The fund delivered gains of 7.31% in 2014, 9.74% in 2015, and a drop of -4.04% in 2016. The following year brought a positive 13.18% and 3.88% in 2018. As for 2019, the fund returned 11.9% through March, with the annualized return of 7.3%.

Insider Monkey’s mission is to identify promising (and also terrible) hedge fund stock pitches and share them with our subscribers. Our long strategy is based on the consensus picks of the 100 best performing hedge funds. This strategy was launched 5 years ago and generated a cumulative return of 115%. You can think of it as a mutual fund that returned 16.2% annually over the last 5 years, vs. 11.1% annual gain for the S&P 500 ETF (SPY). Basically we outperform the S&P 500 Index by 5 percentage points annually by identifying the top stock picks of the best hedge fund managers (see the details here).

Our short strategy is based on shorting hedge fund hotels that are likely to experience large hedge fund sales during market weaknesses. We launched this strategy in February 2017. It’s been almost 2.5 years and the stock picks of this strategy lost a cumulative 24.7% vs. a cumulative gain of 30.8% for the S&P 500 ETF. This is an absolutely mind blowing performance. The annualized return of our short picks is -11.2%, vs. 11.8% annualized gain for the S&P 500 Index during the same period. The annual alpha of this strategy is 23 percentage points. Jim Chanos doesn’t generate this kind of performance. The best thing about this short strategy is that it provides an excellent hedge during market meltdowns. For example, in Q4 of 2018 when the S&P 500 Index lost nearly 14%, this strategy’s picks lost 25% protecting our premium subscribers from large losses.

Our newsletters are successful because we follow hedge fund managers like Michael Stark to identify the best and worst hedge fund stock picks. In this article we are going to take a look at Crosslink Capital’s top stock picks.

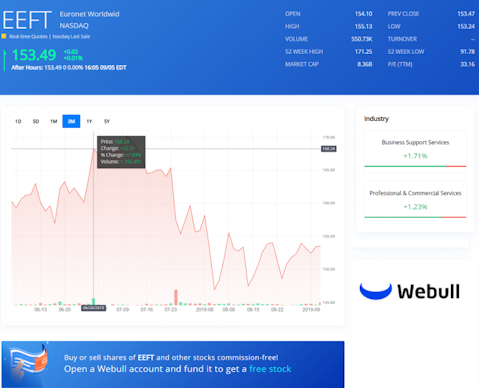

At the fifth place of Crosslink Capital’s top stock picks at the end of the second quarter of 2019 was Euronet Worldwide Inc. (NASDAQ:EEFT). The position was cut by 4%, but it remained at the fifth place in the fund’s portfolio since the previous quarter. At the end of Q2 2019, a total of 33 hedge funds tracked by Insider Monkey were bullish on the stock, the same figure as in Q1 2019. The company’s top shareholder was Arrowstreet Capital, holding shares worth $71.9 million. Columbus Circle Investors, Two Sigma Advisors, and Portolan Capital Management were also among the company’s top shareholders. As you can see from the chart provided by Webull, a commission free trading website, EEFT shares were trading at $264 at the end of last quarter and returned more than 10% so far this quarter.

The fourth most valuable position in the fund’s portfolio at the end of Q2 2019 was Worldplay Inc. (NYSE:WP), boosted by 4% during the quarter. Investors seem to be more interested in the company, since total of 84 shareholders tracked by Insider Monkey were bullish on the stock, which is 12% higher compared to Q1 2019. Among them, Millennium Management held the largest stake in Worldplay Inc., worth $428.8 million. The following company’s top shareholders were Melvin Capital Management, Select Equity Group, Diamond Hill Capital, and Citadel Investment Group.

At the third place of Crosslink Capital’s top stock picks for the second quarter of 2019 was Mercadolibre Inc. (NASDAQ:MELI). During the time, a total of 52 hedge funds were investing in the company, which is 27% higher compared to the previous quarter. The company’s largest shareholder was Viking Global, with a stake worth $522.9 million. Generation Investment Management, D E Shaw, Lone Pine Capital, and Tybourne Capital Management were among other top hedge funds investing in the company.

At the end of Q2 2019 Tableau Software Inc (NYSE:DATA) took the second place in the fund’s portfolio, rising from 11th place, since it was boosted by 92%. A total of 55 hedge funds were bullish on the fund, which is an increase of 72% compared to the previous quarter. The company’s largest shareholder for Q2 2019 was Matrix Capital Management, holding a stake worth $635 million. Other hedge funds investing in the company were Altimer Capital Management Kensico Capital, and HMI Capital.

Even though the fund lowered its stake in this company by 1%, Coupa Software Inc. (NASDAQ:COUP) was the most valuable position in Crosslink Capital’s portfolio at the end of the second quarter this year. The company was in total of 57 hedge fund’s portfolios at the end of Q2 2019, which is an increase of 39% compared to the previous quarter. Among them, the company’s most valuable stake was held by Whale Rock Capital Management, worth $397.7 million. The following top investors were Sylebra Capital Management, Alkeon Capital Management, Viking Global, and Hitchwood Capital Management.

Disclosure: None. This article is originally published at Insider Monkey.