Jay Petschek and Steven Major’s Corsair Capital Management is a New York-based hedge fund that was founded in 2002. The fund was up by 2.5% during the third quarter of 2016 and is up by 3.1% year-to-date. In its quarterly newsletter to investors, the fund wrote about the broader market theme of money moving from active funds to passive funds. They believe that this means non-index stocks are under-owned and undervalued, while the opposite is true for those in the major indices. The fund also wrote about the historically-low interest rates that have created a favorable environment for equities, particularly high dividend-yielding stocks. The fund’s outlook is for slow growth around the world, with interest rates remaining at below-historical-average rates. Corsair Capital expects to continue to own a US-centric portfolio, quite different than that of the S&P 500. In this article, we’ll explore some of the fund’s major additions and sales in the third quarter as well as their commentary on those moves.

Hedge funds and other institutional investors allocate significant resources while making their bets and their long-term focus makes them the perfect investors to emulate. This is supported by our research, which determined that following the small-cap stocks that hedge funds are collectively bullish on can help a smaller investor beat the S&P 500 by around 95 basis points per month (see more details).

Quintiles IMS Holdings Inc. (NYSE:Q) is a biotechnology company engaged in the development and commercialization of pharmaceutical therapies. The company recently reported revenue and adjusted EPS above the consensus expectations and raised its full-year EPS guidance. The company’s strong second-quarter performance led to a good performance for its stock as well. Quintiles IMS Holdings Inc. (NYSE:Q) reported a strong book-to-bill ratio of 1.6x, which provides good visibility about its future revenue.

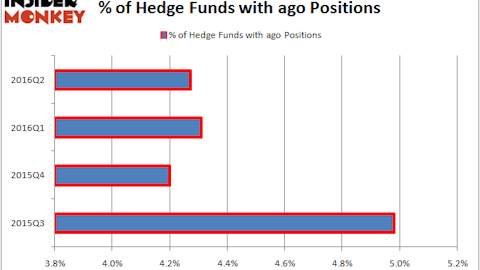

Corsair Capital Management believes that the company’s recent merger with IMS will help the organization going forward. The combined entity could earn up to $8 per share by 2020 and with a 20x multiple could provide significant upside to investors in the future as the current stock price is less than 50% of the fund’s target price. The number of hedge funds in our system holding this stock increased to 37 as of the end of June from 29 a quarter earlier. The value of their holdings also increased by a whopping 78% to $955 million by the end of the second quarter.

Follow Iqvia Holdings Inc. (NYSE:IQV)

Follow Iqvia Holdings Inc. (NYSE:IQV)

Receive real-time insider trading and news alerts

Voya Financial Inc.(NYSE:VOYA) is a financial services company which sells retirement services, annuities, investment management services, mutual funds, and insurance. Though the stock’s performance has been poor over the last 12 months, providing a negative return of 28%, its performance turned around in the second quarter after the company released good quarterly results.

Corsair Capital is positive about the stock since it believes that the company’s management will continue improving return on equity (ROE) towards its 2018 goals, exploring further earnings/capital opportunities, and returning excess capital/FCF to shareholders. The fund thinks that the stock is undervalued and has a target price of $40 per share on it, which would imply 33% upside from the current price. Voya Financial Inc.(NYSE:VOYA)’s management bought almost 4% of the company’s outstanding shares in Q2 and still has enough capital to buy a further 13% of its shares. The number of funds from within our system having a position in this stock also increased to 37 as of June 30, up by seven quarter-over-quarter. They accounted for 19.6% of the company’s float as of June 30.

Follow Voya Financial Inc. (NYSE:VOYA)

Follow Voya Financial Inc. (NYSE:VOYA)

Receive real-time insider trading and news alerts

We’ll check out three more stocks discussed by the fund on the next page.