Bihua Chen‘s Cormorant Asset Management is one of some 750 investors that we track and whose quarterly 13F filings we analyze to identify stocks that they are collectively bullish on. Separately, we calculated the returns of Cormorant’s equity portfolio in the third quarter, by looking at the performance of its long positions in companies with market caps over $1.0 billion held as of the end of June. Since we only use publicly-available data, this method allows us to get an idea whether or not a fund is worth following.

In this way, Cormorant posted a gain of over 20% in the third quarter, based on our analysis that involved a total of 17 relevant holdings from the fund’s last 13F filing. The fund held an equity portfolio worth $705.18 million at the end of June, which was almost completely represented by different healthcare stocks. In this article, we are going to take a closer look at Cormorant’s top positions in companies worth at least $1.0 billion and how they affected the fund’s performance.

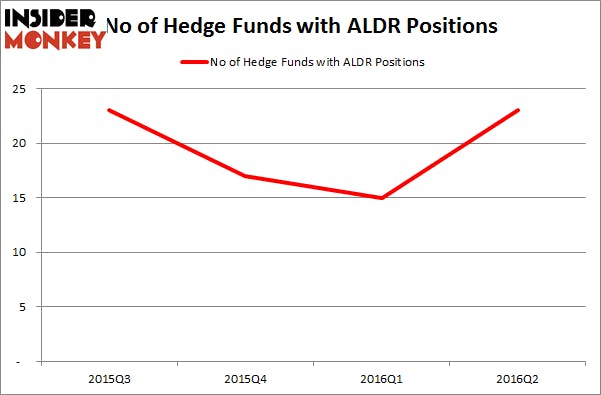

In Alder Biopharmaceuticals Inc (NASDAQ:ALDR), Cormorant held 1.69 million shares heading into the third quarter, during which the stock surged by over 31%. Overall, Alder was in 23 hedge funds’ portfolios at the end of the second quarter of 2016, up by eight funds over the quarter. Among these funds, Partner Fund Management held the most valuable stake in Alder Biopharmaceuticals Inc (NASDAQ:ALDR), which was worth $97.4 at the end of the second quarter. On the second spot was Cormorant Asset Management which amassed $42.2 worth of shares. Moreover, Marshall Wace LLP, Senator Investment Group, and Cadian Capital were also bullish on Alder Biopharmaceuticals Inc (NASDAQ:ALDR).

Follow Alder Biopharmaceuticals Inc (NASDAQ:ALDR)

Follow Alder Biopharmaceuticals Inc (NASDAQ:ALDR)

Receive real-time insider trading and news alerts

Next in line is Nevro Corp (NYSE:NVRO), which returned 41.5% during the third quarter. Cormorant held 491,044 shares of Nevro Corp at the end of June, being one of the 31 funds tracked by us that were bullish on the company. During the second quarter, the number of funds with long positions went up by seven. The largest stake in Nevro Corp (NYSE:NVRO) was held by Columbus Circle Investors, which reported holding $78 worth of stock at the end of June. It was followed by Citadel Investment Group with a $54.2 position. Other investors bullish on the company included Cormorant Asset Management, Redmile Group, and Broadfin Capital.

Follow Nevro Corp (NYSE:NVRO)

Follow Nevro Corp (NYSE:NVRO)

Receive real-time insider trading and news alerts

On the following page, we will take a look at two other investments of Cormorant.

At the end of the second quarter, TESARO Inc (NASDAQ:TSRO) saw 28 funds from our database holding shares, up by 47% over the quarter. Among them was Cormorant, which owned 362,875 shares at the end of June. However, the largest stake in TESARO Inc (NASDAQ:TSRO) was held by Perceptive Advisors, which reported holding $96.1 worth of stock at the end of June. It was followed by Passport Capital with a $61.7 position. Other investors bullish on the company included venBio Select Advisor, Rock Springs Capital Management, and Cormorant Asset Management. During the third quarter, TESARO’s shares gained 19%.

Follow Tesaro Inc. (NASDAQ:TSRO)

Follow Tesaro Inc. (NASDAQ:TSRO)

Receive real-time insider trading and news alerts

In Nektar Therapeutics (NASDAQ:NKTR), Cormorant reported ownership of some 2.02 million shares as of the end of June. In the following three months, the stock advanced by 20.7%. Overall, at the end of the second quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, down by 15% compared to the first quarter of 2016. Among these funds, Camber Capital Management held the most valuable stake in Nektar Therapeutics (NASDAQ:NKTR), which was worth $60.5 at the end of the second quarter. On the second spot was Bridger Management which amassed $51.2 worth of shares. Moreover, RA Capital Management, Cormorant Asset Management, and Tang Capital Management were also bullish on Nektar Therapeutics (NASDAQ:NKTR).

Follow Nektar Therapeutics (NASDAQ:NKTR)

Follow Nektar Therapeutics (NASDAQ:NKTR)

Receive real-time insider trading and news alerts

Disclosure: none