The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. In this article we look at what those investors think of Constellation Brands, Inc. (NYSE:STZ).

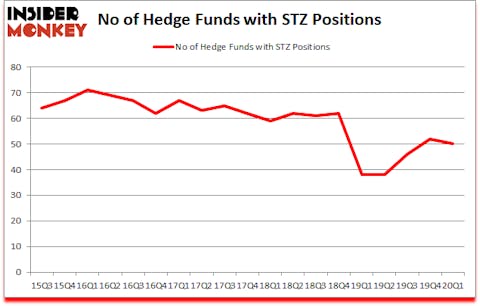

Is Constellation Brands, Inc. (NYSE:STZ) undervalued? The smart money is becoming less hopeful. The number of long hedge fund bets were cut by 2 in recent months. Our calculations also showed that STZ isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are viewed as unimportant, outdated investment vehicles of yesteryear. While there are over 8000 funds trading today, We choose to focus on the masters of this club, around 850 funds. It is estimated that this group of investors preside over the majority of all hedge funds’ total capital, and by keeping an eye on their top equity investments, Insider Monkey has revealed a few investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Michael Lowenstein of Kensico Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this successful trader’s “corona catalyst plays“. Also, Europe is set to become the world’s largest cannabis market, so we checked out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to check out the latest hedge fund action regarding Constellation Brands, Inc. (NYSE:STZ).

Hedge fund activity in Constellation Brands, Inc. (NYSE:STZ)

At the end of the first quarter, a total of 50 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the previous quarter. On the other hand, there were a total of 38 hedge funds with a bullish position in STZ a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Kensico Capital, managed by Michael Lowenstein, holds the biggest position in Constellation Brands, Inc. (NYSE:STZ). Kensico Capital has a $586.2 million position in the stock, comprising 16% of its 13F portfolio. On Kensico Capital’s heels is Palestra Capital Management, managed by Andrew Immerman and Jeremy Schiffman, which holds a $96 million position; 3.1% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that are bullish encompass Ryan Pedlow’s Two Creeks Capital Management, Jack Woodruff’s Candlestick Capital Management and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Kensico Capital allocated the biggest weight to Constellation Brands, Inc. (NYSE:STZ), around 16.02% of its 13F portfolio. Freshford Capital Management is also relatively very bullish on the stock, designating 11.87 percent of its 13F equity portfolio to STZ.

Because Constellation Brands, Inc. (NYSE:STZ) has faced falling interest from the entirety of the hedge funds we track, we can see that there exists a select few fund managers who were dropping their entire stakes heading into Q4. Interestingly, Renaissance Technologies dumped the largest position of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $46 million in stock. Oscar Hattink’s fund, BlueDrive Global Investors, also sold off its stock, about $32.3 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 2 funds heading into Q4.

Let’s check out hedge fund activity in other stocks similar to Constellation Brands, Inc. (NYSE:STZ). These stocks are Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC), Lloyds Banking Group PLC (NYSE:LYG), Consolidated Edison, Inc. (NYSE:ED), and Eversource Energy (NYSE:ES). This group of stocks’ market valuations are closest to STZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ERIC | 20 | 366624 | 2 |

| LYG | 9 | 37400 | 4 |

| ED | 25 | 844776 | -1 |

| ES | 26 | 460667 | 2 |

| Average | 20 | 427367 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $427 million. That figure was $1505 million in STZ’s case. Eversource Energy (NYSE:ES) is the most popular stock in this table. On the other hand Lloyds Banking Group PLC (NYSE:LYG) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Constellation Brands, Inc. (NYSE:STZ) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 7.9% in 2020 through May 22nd but still managed to beat the market by 15.6 percentage points. Hedge funds were also right about betting on STZ as the stock returned 20.8% so far in Q2 (through May 22nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Constellation Brands Inc. (NYSE:STZ)

Follow Constellation Brands Inc. (NYSE:STZ)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.