The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th. We at Insider Monkey have made an extensive database of more than 867 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Coinbase Global Inc. (NASDAQ:COIN) based on those filings.

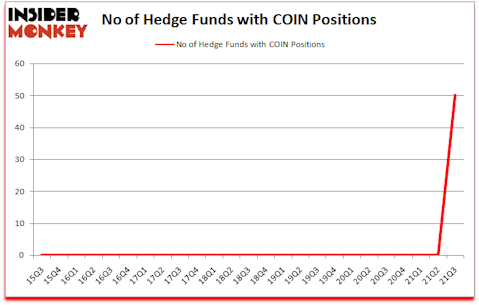

Is Coinbase Global Inc. (NASDAQ:COIN) a buy right now? Prominent investors were turning bullish. The number of bullish hedge fund bets inched up by 50 lately. Coinbase Global Inc. (NASDAQ:COIN) was in 50 hedge funds’ portfolios at the end of the third quarter of 2021. Our calculations also showed that COIN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s analyze the key hedge fund action encompassing Coinbase Global Inc. (NASDAQ:COIN).

Glen Kacher of Light Street Capital

Do Hedge Funds Think COIN Is A Good Stock To Buy Now?

At the end of September, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50 from the second quarter of 2021. By comparison, 0 hedge funds held shares or bullish call options in COIN a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, ARK Investment Management held the most valuable stake in Coinbase Global Inc. (NASDAQ:COIN), which was worth $1590.8 million at the end of the third quarter. On the second spot was Tiger Global Management LLC which amassed $608.9 million worth of shares. Citadel Investment Group, Citadel Investment Group, and Atreides Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Axel Capital Management allocated the biggest weight to Coinbase Global Inc. (NASDAQ:COIN), around 10.6% of its 13F portfolio. Light Street Capital is also relatively very bullish on the stock, designating 4.93 percent of its 13F equity portfolio to COIN.

As industrywide interest jumped, some big names were breaking ground themselves. Light Street Capital, managed by Glen Kacher, initiated the most outsized position in Coinbase Global Inc. (NASDAQ:COIN). Light Street Capital had $98.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $16.3 million position during the quarter. The following funds were also among the new COIN investors: Lei Zhang’s Hillhouse Capital Management, Zach Schreiber’s Point State Capital, and Kevin Cottrell and Chris LaSusa’s KCL Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Coinbase Global Inc. (NASDAQ:COIN) but similarly valued. These stocks are Eni SpA (NYSE:E), Freeport-McMoRan Inc. (NYSE:FCX), Fortinet Inc (NASDAQ:FTNT), Agilent Technologies Inc. (NYSE:A), Enterprise Products Partners L.P. (NYSE:EPD), American International Group Inc (NYSE:AIG), and Exelon Corporation (NASDAQ:EXC). This group of stocks’ market valuations are closest to COIN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| E | 3 | 75414 | 0 |

| FCX | 66 | 3213384 | -10 |

| FTNT | 38 | 1139238 | 6 |

| A | 46 | 3135637 | 7 |

| EPD | 25 | 233255 | -3 |

| AIG | 30 | 1904264 | -9 |

| EXC | 36 | 1108781 | 1 |

| Average | 34.9 | 1544282 | -1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.9 hedge funds with bullish positions and the average amount invested in these stocks was $1544 million. That figure was $2968 million in COIN’s case. Freeport-McMoRan Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand Eni SpA (NYSE:E) is the least popular one with only 3 bullish hedge fund positions. Coinbase Global Inc. (NASDAQ:COIN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for COIN is 69.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Hedge funds were also right about betting on COIN as the stock returned 38.5% since the end of Q3 (through 11/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Coinbase Global Inc. (NASDAQ:COIN)

Follow Coinbase Global Inc. (NASDAQ:COIN)

Receive real-time insider trading and news alerts

Suggested Articles:

- Billionaire Ken Griffin’s Top 10 Stock Holdings

- 30 Most Religious Cities in the US

- 10 Best Large-cap Stocks To Buy Now

Disclosure: None. This article was originally published at Insider Monkey.