Broadcom Inc. (NASDAQ:AVGO) is one of the 10 best tech stocks to buy according to billionaires right now. On June 9, a Citi analyst raised his price target on Broadcom from $276 to $285 while maintaining a Buy rating. This revision follows Broadcom’s second-quarter results, which showed continued strength in AI-related revenue, although overall performance was mixed, as per the analyst, due to some pressure on margins.

Broadcom continues to benefit from growing demand in the artificial intelligence space, which remains a key driver of topline performance. The company reported Q2 FY 2025 revenue of $15.0 billion, up 20% year-over-year supported by strong AI semiconductor sales and contributions from VMware. Adjusted EBITDA rose 35% year-over-year to $10.0 billion, implying an EBITDA margin of 67%.

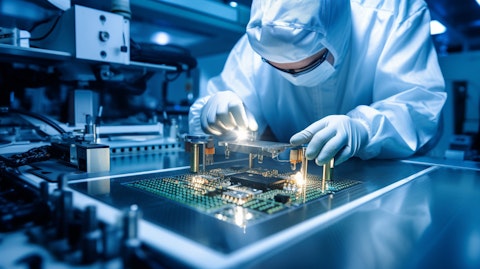

A worker assembling the inner circuitry of a semiconductor product.

AI-related revenue reached $4.4 billion in Q2, growing 46% year-over-year, driven primarily by demand for AI networking solutions. Management expects this momentum to carry into Q3, with AI semiconductor revenue projected to reach $5.1 billion. This growth is supported by continued investment by hyperscale customers.

Looking ahead, Broadcom guided for Q3 FY25 revenue of approximately $15.8 billion and an adjusted EBITDA margin of at least 66% of revenue, which is slightly below versus Q2.

However, the company’s margin outlook raised some concerns. According to the analyst, an increased contribution of semiconductor sales in total sales has put pressure on profitability. In response, management has adjusted its guidance, which indicates a slightly lower margin in the near term.

Broadcom Inc. (NASDAQ:AVGO) is a global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions. The company’s products play a crucial role in enterprise and data center networking, broadband access, storage systems, smartphones, and wireless communications. Broadcom’s extensive portfolio includes solutions for data center networking, storage, and security, making it a key player in the data center ecosystem.

While we acknowledge the potential of AVGO as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None.