Notwithstanding the fact that Ubiquisys was the right choice to ensure Cisco’s fast progress in the femtocell and Wi-Fi technology, the question is whether the price of $310 million is bearable for Cisco Systems, Inc. (NASDAQ:CSCO) or not. In short, how does it affect the fundamentals with three consecutive acquisitions — Ubiquisys ($310 million), Intucell ($475 million), and BroadHop?

Just after the acquisition announcement, Fox Business cut its rating of Cisco Systems, Inc. (NASDAQ:CSCO)’s stock, quoting that it “will become increasingly more challenged to offset weaker-than-expected routing and switching demand as it works to transition to a more software and service centric business model,” according to Bloomberg Business Week.

And while that sounds logical, it is made all the more scary with the graph below.

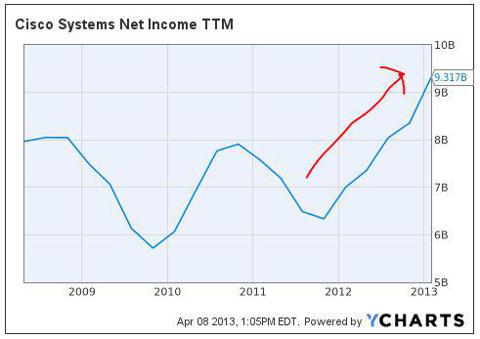

The business transition might affect the total revenue of the company. So, we can say the annual sales might just be stuck at $46 billion as in 2012, while research and development expenses (along with other expenses) will probably soar again in 2013. That will result in a drop in net income, affecting shareholders’ returns negatively.

Nevertheless, net income (TTM) has always followed a jagged path since 2008. It rose since mid-2012. Will it be able to continue the uptrend? That remains to be seen but it might not.

That said, it must be remembered that the gross margin of 61.24% and the operating margin of 21.85% are still, by far, one of the highest among its immediate peers, not to mention Alcatel-Lucent which is running in the negative.

Moreover, with over $48 billion in cash and only around $16 billion in debt sitting on the balance sheet, I would not worry too much about financial health right now. What matters is how efficiently the company is utilizing its investment base of $40 billion. With a market cap of $109.5 billion, there is sufficient economic moat around this company, and unless it messes up its own business, it should come out stronger by 2015.

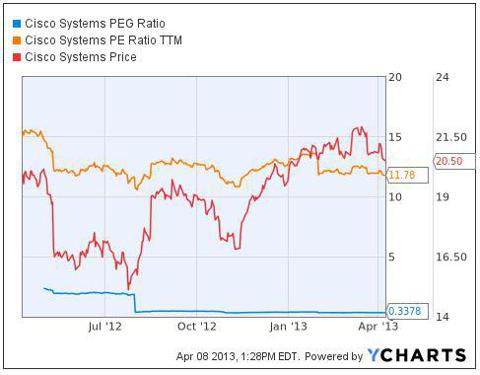

However, the price-to-sales ratio of 2.39 says that the stock is overvalued. With stagnancy in revenue in the next couple of years, the stock price will definitely see a decline in the short-term. Just to confirm that, with a higher price and stagnant P/E ratio, the price might go down if EPS stays stagnant or goes down in the short-term.

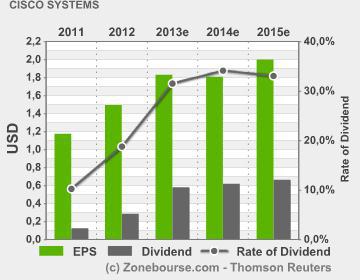

And the sad part is that EPS is estimated to be more or less stagnant in the next couple of years, which will probably result in a steep price decline.

Additionally, with the high dividend payment being increased for the shareholders last March, and which is expected to increase in the next two years, there is still much value in holding the stock.

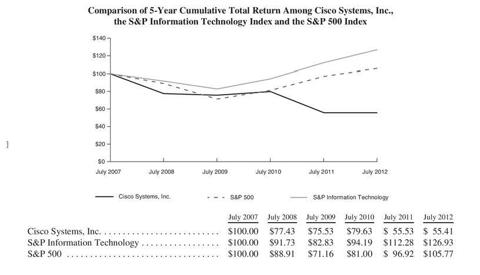

To sum it up, it is really hard to take any solid decision right now. While all the fundamentals tell me that the company is going to do well in the long run, the last five-years’ total return makes me wonder whether that is reliable or not.

In all honesty, investors who put their money based on value of the company back in 2007 burnt their hands badly. But, then again, it was the period of the Great Recession and that might not happen again. And if I were to trust Cisco Systems, Inc. (NASDAQ:CSCO) with my money again, I would not do it now. I will let the price go down a bit, and then take the plunge.

The article Cisco, Ubiquisys, and the Small Cell Industry originally appeared on Fool.com is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.