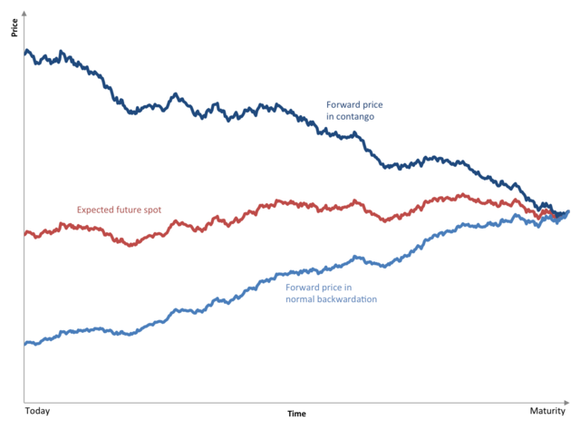

Contango is a term used when a trader is talking about a forward or futures contract. Normally, a forward or futures curve will have an upward slope to it meaning that traders are willing to pay more for the underlying commodity or contract in the future. The market is said to be in contango when traders are willing to pay more today than they are in the future. The following graph helps to display this more visually:

Source: Suicup

This term can come into play when investing in the energy markets. When natural gas or oil is in contango, a producer might want to lock in the price of oil and gas to get a better short-term price to ensure its profits. That’s because if a market is in contango it means that the company can earn more money by selling short-term contracts as opposed to a longer-term contract. Let’s take a look at a couple of examples of how this can play out with your investments.

Natural gas prices have played havoc on the stock of Chesapeake Energy Corporation (NYSE:CHK). The company invested heavily to drill for gas when the price was high but profits were hurt when the price of natural gas sunk. Because of how volatile natural gas prices are, the company looks to hedge some of its production in order to mitigate some of that volatility from quarter to quarter. This year the company has hedged 78% of its natural gas production at an average of $3.72 per thousand cubic feet.

Let’s say Chesapeake Energy Corporation (NYSE:CHK) was nervous about the price of gas for the rest of the year and it wanted to hedge the other 22% of its volumes. If the market is in contango, Chesapeake Energy Corporation (NYSE:CHK) would realize greater value by hedging for a shorter duration because the shorter duration contract would be worth more than a longer duration contract. However, hedging works both ways — the company could lock in the price only to see prices spike higher, and therefore it would miss the upside. Then again, prices could plunge, meaning that the shorter contract won’t help in future quarters.

Contango can also affect a company like Linn Energy LLC (NASDAQ:LINE) which seeks to hedge all of its production for the long term. A good example of this can be seen last year when Linn Energy LLC (NASDAQ:LINE) bought the Jonah Field from BP plc (ADR) (NYSE:BP). Upon closing the deal, Linn Energy LLC (NASDAQ:LINE) hedged 100% of the expected oil and natural gas production through 2017. If the market were in contango at the time it could have had an impact on the future profits LINN expects to produce from that asset. It would mean that production sold just after closing would have netted a higher sale price than oil and gas that won’t be produced until 2017. That’s one reason why Linn Energy LLC (NASDAQ:LINE) had been using puts to hedge its production; it wanted to keep some of that upside.