Many Canadian dividend stocks offer attractive yields and boast consistent earnings power and dividend growth. One of the dividend exchange-traded funds (ETFs) that provide an exposure to the Canadian dividend universe is Horizons AlphaPro Dividend ETF (HAL.TO). This ETF trades on the Toronto Stock Exchange. It gives investors an opportunity to invest in a pool of Canadian stocks that offer long-term total returns consisting of dividend income and modest long-term capital growth.

We took a closer look at the stocks comprising the noted ETF. Given that Horizon AlphaPro Dividend ETF focuses predominantly on Canadian companies with above-average dividend yields, there are many individual dividend stocks in the fund that can serve as income investments. Most of the stocks trade at both Canadian and U.S. public exchanges. Here is a quick glance at five such Canadian large-cap companies that offer an average yield of 4.0% and consistent dividend growth over the past five years.

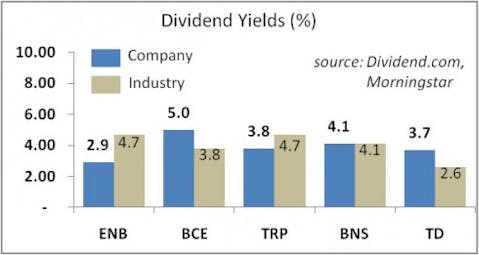

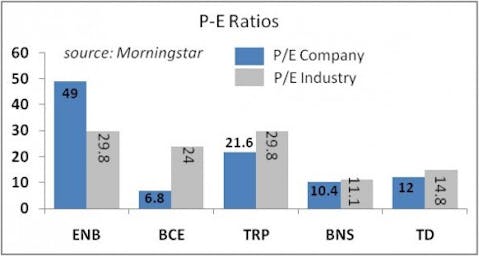

Enbridge Inc. (NYSE:ENB) is a company engaged in the transportation of oil and natural gas in Canada and the United States. The company also owns and operates Canada’s largest natural gas distribution company. It is also one of the S&P/TSX Canadian Dividend Aristocrats. Enbridge pays a dividend yield of 2.9% on a payout ratio of 144% of trailing earnings. The company’s peers TransCanada Corp. (NYSE:TRP) and Kinder Morgan Energy Partners LP (NYSE:KMP) pay dividend/distribution yields of 3.8% and 5.9%, respectively. Over the past five years, Enbridge’s EPS and dividends grew at average annual rates of 9.3% and 15.0% per year, respectively. For the next five years, EPS growth is expected to average about the same as over the past five years. On a five-year average basis, the company’s ROE is 16.1% and its return on invested capital [ROIC] is 5.5%. Enbridge has a high P/E of 49, which compares with an average industry P/E of nearly 30 and the stock’s five-year average ratio of 18.8. The stock is a new holding in the portfolio of billionaire fund manager D. E. Shaw (see his top holdings).

BCE Inc. (NYSE:BCE) is a provider of wire-line, wireless, Internet, and TV services in Canada. The stock yields 5.0% on a payout ratio of 66%. The company’s competitors Rogers Communications Inc. (NYSE:RCI) and TELUS Corporation (NYSE:TU) pay dividend yields of 3.9% and 4.0%, respectively. Despite a contraction in its EPS over the past half decade, BCE Inc.’s dividends grew at an average annual rate of nearly 11% per year. Analysts forecast that the company will expand its EPS at an average rate of about 4% per year for the next five years. The stock has a free cash flow yield of 1.5%, ROE of 25% and ROIC of 9.4%. As regards the stock’s valuation, BCE Inc. is trading at a major discount to its respective industry and historical valuation metrics. Its P/E of 6.8 compares to an industry average P/E of 24 and the stock’s five-year average ratio of 14.3. However, the stock is overvalued relative to its industry based on a price-to-book ratio. The stock is popular with fund manager Louis Navellier (Navellier & Associates).

Transcanada Corp. (NYSE:TRP) is a Canadian company operating oil and natural gas pipelines and gas storage facilities, as well as electric power utilities. It is also ranked as one of the S&P/TSX Canadian Dividend Aristocrats. The stock yields 3.8% on a payout ratio of 87%. Its main rival Enbridge Inc. pays a lower dividend yield. Over the past five years, Transcanada Corp.’s EPS and dividends grew at average annual rates of 0.3% and 7.6%, respectively. EPS growth is expected to accelerate to 7.4% per year for the next five years. The stock has an ROE of 9.8% and ROIC of 4.3%. In terms of valuation, Transcanada Corp. has a P/E of 21.6, which compares to an industry average P/E of 29.8 and the stock’s five-year average P/E of 18. The stock is, however, trading at a discount to its industry, based on a price-to-book ratio. Among fund managers, billionaire Ray Dalio has a small stake in the company.

Bank of Nova Scotia (NYSE:BNS) is Canada’s third largest bank and one of the S&P/TSX Canadian Dividend Aristocrats. The bank pays a dividend yield of 4.1% on a payout ratio of 45%. The bank’s main competitors Bank of Montreal (NYSE:BMO), Royal Bank of Canada (NYSE:RY), and Toronto-Dominion Bank (NYSE:TD) pay dividend yields of 4.8%, 4.2%, and 3.7%, respectively. Over the past five years, the bank’s EPS and dividends grew at average rates of 5.5% and 7.0%, respectively. For the next five years, the bank’s EPS is expected to expand at an average annual rate of 8.8%. The bank has an ROE of 19%. It trades on a price-to-book ratio of 1.9, on par with its industry. The stock is popular with fund manager Daniel Bubis (Tetrem Capital Management—check out its top holdings) and billionaire D. E. Shaw.

Toronto-Dominion Bank (NYSE:TD) is the second-largest Canadian bank. It is also one of the S&P/TSX Canadian Dividend Aristocrats. This bank pays a dividend yield of 3.7% on a payout ratio of 47%. Its peers Bank of Nova Scotia, Bank of Montreal, and Royal Bank of Canada all pay higher dividend yields. Over the past half decade, the bank’s EPS and dividends grew at average rates of 2.7% and 8.9% per year, respectively. Analysts forecast that the bank’s EPS will grow at a faster 7.5% average annual rate for the next five years. Toronto-Dominion Bank has an ROE of close to 15%. Its price-to-book ratio is 1.7. On a P/E basis, the stock is trading below the industry average ratio. The bank represents the largest holding—valued at more than $300 million—in Tetrem Capital’s portfolio.