Baron Funds, an investment management company, released its “Baron Emerging Markets Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. In the fourth quarter, the fund gained 8.58% (Institutional Shares), compared to a 9.70% return for its principal benchmark, the MSCI EM Index, and a 9.28% gain for the MSCI EM IMI Growth Index. In the year, the fund declined 25.82% compared to the MSCI EM Index’s 20.09% decline and the MSCI EM IMI Growth Index’s 23.88% decline. In addition, please check the fund’s top five holdings to know its best picks in 2022.

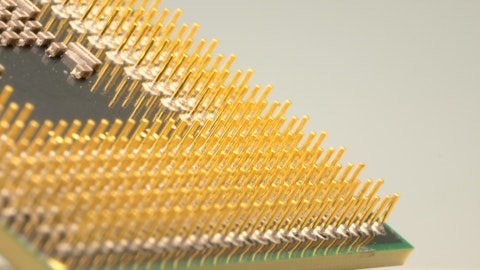

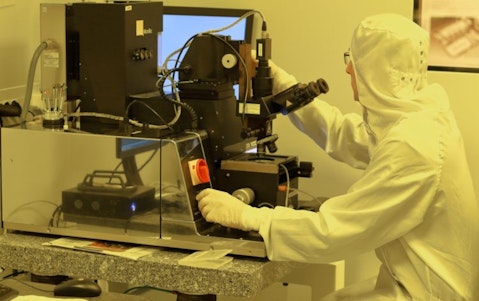

Baron Emerging Markets Fund highlighted stocks like Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in the Q4 2022 investor letter. Headquartered in Hsinchu City, Taiwan, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is an integrated circuit and other semiconductor device manufacturer. On March 13, 2023, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock closed at $87.74 per share. One-month return of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was -10.43%, and its shares lost 14.06% of their value over the last 52 weeks. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has a market capitalization of $455.027 billion.

Baron Emerging Markets Fund made the following comment about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q4 2022 investor letter:

“Semiconductor giant Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) contributed in the fourth quarter due to easing geopolitical concerns and expectations for end-demand recovery later in 2023. We retain conviction that Taiwan Semi’s technological leadership, pricing power, and exposure to secular growth markets, including high-performance computing, automotive, 5G, and IoT, will allow the company to sustain strong earnings growth over the next several years.”

l-n-r2tVRjxzFM8-unsplash

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 86 hedge fund portfolios held Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) at the end of the fourth quarter which was 87 in the previous quarter.

We discussed Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article and shared the list of hot growth stocks to buy. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Largest Economies in Europe

- 12 Best Lithium and Battery Stocks to Buy

- 12 Biggest Palm Oil Companies in the World

Disclosure: None. This article is originally published at Insider Monkey.