Columbia Threadneedle Investments, an investment management company, released its “Columbia Threadneedle Global Technology Growth Strategy” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. The market experienced volatility at the start of the quarter due to heightened uncertainty from global tariffs as part of the new U.S. administration. Later, the market rebounded with the implementation of a more lenient trade policy. The composite returned 25.11% gross of fees and 24.85% net of fees in the quarter, compared to the S&P Global 1200 Information Technology Index’s 23.66% return. In addition, you can check the fund’s top 5 holdings for its best picks for 2025.

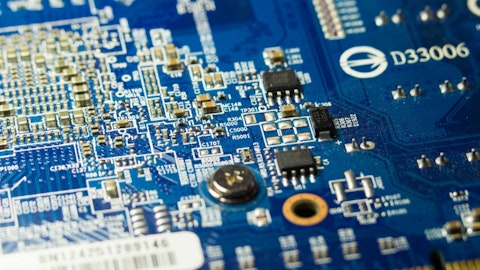

In its second-quarter 2025 investor letter, Columbia Threadneedle Global Technology Growth Strategy highlighted stocks such as Broadcom Inc. (NASDAQ:AVGO). Broadcom Inc. (NASDAQ:AVGO) designs and develops various semiconductor and infrastructure software solutions. The one-month return of Broadcom Inc. (NASDAQ:AVGO) was 13.68%, and its shares gained 93.77% of their value over the last 52 weeks. On September 22, 2025, Broadcom Inc. (NASDAQ:AVGO) stock closed at $338.79 per share, with a market capitalization of $1.6 trillion.

Columbia Threadneedle Global Technology Growth Strategy stated the following regarding Broadcom Inc. (NASDAQ:AVGO) in its second quarter 2025 investor letter:

“Shares of fellow semiconductor giant Broadcom Inc. (NASDAQ:AVGO) also outperformed during the quarter, as customer demand for the company’s custom accelerator chips remained insatiable despite the uncertain economic environment. The company is on pace for 10 consecutive quarters of AI-related semiconductor growth and expects continued strong demand persist, due to the sizable AI opportunity. In addition to its dominant market position, the company’s history of strong capital returns to shareholders results in a favorable outlook for a sizable investor base.”

Broadcom Inc. (NASDAQ:AVGO) is in 12th position on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 156 hedge fund portfolios held Broadcom Inc. (NASDAQ:AVGO) at the end of the second quarter, compared to 158 in the previous quarter. In the fiscal third quarter of 2025, Broadcom Inc. (NASDAQ:AVGO) reported record revenue of $16 billion, up 22% year-over-year. While we acknowledge the risk and potential of Broadcom Inc. (NASDAQ:AVGO) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Broadcom Inc. (NASDAQ:AVGO) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Broadcom Inc. (NASDAQ:AVGO) and shared the list of best innovative stocks to buy. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.