Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

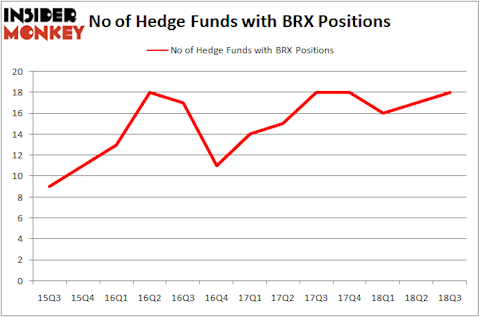

Brixmor Property Group Inc (NYSE:BRX) investors should be aware of an increase in hedge fund interest recently. Our calculations also showed that BRX isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a lot of tools stock market investors put to use to size up publicly traded companies. A pair of the most underrated tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best money managers can outpace their index-focused peers by a healthy margin (see the details here).

Let’s take a gander at the key hedge fund action encompassing Brixmor Property Group Inc (NYSE:BRX).

What have hedge funds been doing with Brixmor Property Group Inc (NYSE:BRX)?

Heading into the fourth quarter of 2018, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the previous quarter. By comparison, 18 hedge funds held shares or bullish call options in BRX heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in Brixmor Property Group Inc (NYSE:BRX). Renaissance Technologies has a $55.1 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Citadel Investment Group, managed by Ken Griffin, which holds a $43.8 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other peers that are bullish include Israel Englander’s Millennium Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and Mark T. Gallogly’s Centerbridge Partners.

Now, some big names were breaking ground themselves. Stevens Capital Management, managed by Matthew Tewksbury, initiated the most outsized position in Brixmor Property Group Inc (NYSE:BRX). Stevens Capital Management had $4.3 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $0.2 million position during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Brixmor Property Group Inc (NYSE:BRX). We will take a look at CubeSmart (NYSE:CUBE), The Dun & Bradstreet Corporation (NYSE:DNB), H&R Block, Inc. (NYSE:HRB), and Williams-Sonoma, Inc. (NYSE:WSM). This group of stocks’ market valuations match BRX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CUBE | 20 | 448124 | 1 |

| DNB | 34 | 792527 | 10 |

| HRB | 18 | 182945 | -2 |

| WSM | 23 | 560651 | 1 |

| Average | 23.75 | 496062 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $496 million. That figure was $291 million in BRX’s case. The Dun & Bradstreet Corporation (NYSE:DNB) is the most popular stock in this table. On the other hand H&R Block, Inc. (NYSE:HRB) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Brixmor Property Group Inc (NYSE:BRX) is even less popular than HRB. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.