Apple Inc. (NASDAQ:AAPL) is incessantly compared to Microsoft Corporation (NASDAQ:MSFT), and rightfully so, but a recent analysis by Piper Jaffray’s Gene Munster and his team took this to the next level. We’ve already covered just how bullish Munster has been about the Cupertino-based tech company in the past, so it may come as no surprise to see what went down on Black Friday.

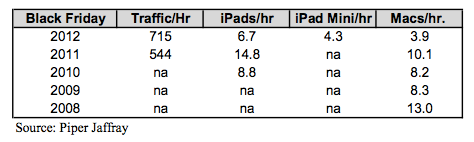

In a story that was originally posted by Fortune, “Munster’s crew spent eight hours on Black Friday, as it has every year for the past five years, counting heads at the Apple Store in the Mall of America in Minneapolis. This year he (or his staff) also spent two hours monitoring the Microsoft Store directly across the hall.” In a quick-and-dirty version of the study’s results, the following table was also released with regard to Apple:

Even more interesting though, is the comparison – to Apple – of Black Friday sales at Microsoft Corporation (NASDAQ:MSFT)’s Mall of America store. In that same Fortune article, the “findings” from two hours spent at the competitor’s store found that: (1) “foot traffic” at Microsoft’s store was “47% less” than that at Apple’s store, (2) “[s]hoppers bought 17.2 items per hour at the Apple Store and only 3.5 items per hour at the Microsoft Store,” and (3) “[d]espite heavy TV, print and billboard advertising for the new Microsoft Surface tablet, not one was sold sold during the two hours Piper Jaffray spent monitoring that store.”

While it’s tempting to declare that this “[d]oesn’t bode well for Microsoft’s answer to the iPad” as some have said, it’s unclear just how two hours of observation – and eight in the case of Apple Inc. (NASDAQ:AAPL) – makes it possible to come to this conclusion. There is nothing wrong with providing investors a little bit of real-world feedback on Black Friday – that’s part of the reason why Munster (and his team at Piper Jaffray) is widely regarded as one of the top Apple analysts out there. Where we start getting into trouble, though, is how far armchair analysts take these results.

The reasons that we can’t justifiably compare Apple to Microsoft Corporation (NASDAQ:MSFT) in a mano-y-mano, physical store showdown, are plentiful. For starters, Microsoft’s own stores have been open since the fall of 2009, while those of Apple have been standing for close to a full decade longer. In layman’s terms, this means that the folks at Cupertino have had a considerably larger amount of time to increase tech customers’ awareness of their outlets, which undoubtedly has a factor on sales (especially on a shopping day as important as Black Friday).

A secondary way that we can see Apple Inc. (NASDAQ:AAPL)’s age advantage is in the sheer number of stores it has (370+) compared to Microsoft (32 full-time, 34 holiday pop-up stores). While it isn’t reported just how much revenue Microsoft makes from its physical stores – Apple’s account for far less than half of tablet sales – it’s safe to say that sales at third-party retailers are a more important metric of success, especially in Microsoft’s case. A broad-based survey of consumer preferences at stores like Wal-Mart Stores, Inc. (NYSE:WMT) and Best Buy Co., Inc. (NYSE:BBY) might have proved more useful, and would have at least given the media the tools to determine just how the ‘Apple vs. Microsoft’ battle shaped up this Black Friday.