BiomX Inc. (AMEX:PHGE) Q4 2022 Earnings Call Transcript March 31, 2023

Operator: Good morning, and welcome to the BiomX Full Year 2022 Financial Results and Corporate Update Conference Call. Currently, all participants are in a listen-only mode. There will be a question-and-answer session at the end of this call. I would now like to turn the call over to Marina Wolfson, Chief Financial Officer of BiomX. Please go ahead.

Marina Wolfson: Thank you, and welcome to the BiomX 2022 financial results and corporate update conference call. The news release became available just after 6:30 a.m. Eastern Time today and can be found on our website at biomx.com. A replay of this call will be available on the Investors section of our website. Before we begin, I’d like to review the safe harbor provision. All statements on this call that are not factual historic statements may be deemed forward-looking statements. For instance, we’re using forward-looking statements when we discuss on the conference call, potential market opportunities, the design, aim, expected timing and interim and final results of our preclinical and clinical trials, the sufficiency of our existing cash, cash equivalents and short-term deposits, the potential to close on the second part of the PIPE transaction and the potential safety, efficacy and other benefits of our product candidates.

In addition, past preclinical and clinical results as well as compassionate use are not indicative and do not guarantee future success of our clinical trials. Except as required by law, we do not undertake to update forward-looking statements. The full safe harbor provision, including risks that could cause actual results to differ from these forward-looking statements are outlined in today’s press release, which, as noted earlier, is on our website. Joining me on the call this morning is Jonathan Solomon, Chief Executive Officer of BiomX. With that, I will turn the call over to Jonathan.

Jonathan Solomon: Thank you, Marina, and good morning, everyone. 2023 is shaping up to be a very exciting year for our company. Our cystic fibrosis program with lead candidate, BX004, continues to gain momentum based on the positive results announced back in late February in Part 1 of our ongoing Phase 1b/2a study. Without question, this was a watershed moment for our company and for our technology. As these results demonstrated an optimized phage cost of product developed utilizing on both platforms, such as BX004 could potentially reduce the presence of life-threatening bacteria in the lungs of CF patients after a short period of treatment. The Part 1 results also represented the first placebo-controlled study evaluating a cocktail-based phage product to show notable reductions in bacterial burden in cystic fibrosis patients.

As a reminder, BX004 is a phage cocktail that has been designed to combat chronic pulmonary infections caused by Pseudomonas Aeruginosa or PsA, which is a main contributor to morbidity and mortality in CF patients. Despite the availability of CFTR directed therapies, CF patients continue to suffer from intractable, persistent infections, such as those caused by P. aeruginosa. New treatment options are, therefore, needed to address the significant unmet need that impacts thousands of CF patients each year. Our ongoing Phase 1b/2a trial is comprised of two parts. Part 1 evaluated the safety, pharmacokinetics and microbiologic activity of BX004 in nine CF patients in a single ascending dose and multiple dose design. On February 22, we reported these exciting results and also held a conference call with investors to review the data.

For today’s call, I plan on providing a high-level overview of the overall study results. However, a more detailed presentation of our data can be accessed on the BiomX website under our Investor Relations, News Events section. Part 2 of the trial will evaluate the safety and efficacy of BX004 in a larger group of patients with 16 patients receiving nebulized BX004 and 8 patients receiving placebo in a 2:1 randomization. Importantly, treatment duration will be extended over a 10-day period with twice-daily administration of the high dose versus the seven-day period of escalating doses in Part 1. We have already started dosing patients in Part 2 of the study, and we remain on track to report results in the third quarter of this year. I’d now like to briefly recap the exciting results in Part 1 of our CF study.

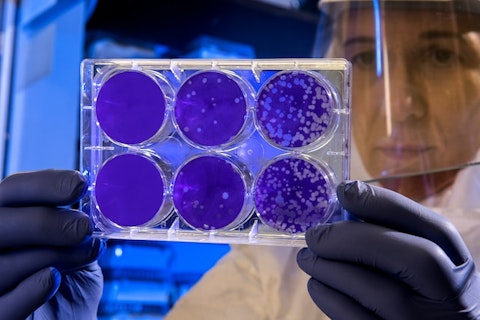

Photo by CDC on Unsplash

The primary goal of Part 1 was to assess the safety and tolerability of BX004. Phage therapies are generally considered safe and that proved to be the case with BX004 maintaining an excellent safety profile throughout the course of treatment. However, we are also highly encouraged to see preliminary evidence of efficacy in patients treated with BX004 despite the small sample size and short duration of treatment during this first part of the trial. At Day 15, patients treated with BX004 had a mean reduction in PsA colony-forming units or CFUs compared to baseline of 1.42 log, while the mean reduction in PsA CFUs was only 0.28 log for placebo-treated patients. As noted on our conference call last month, we were surprised by the magnitude of reduction in bacterial load and these results exceeded our internal expectations, particularly considering the shorter course of treatment of just seven days of escalating dose.

Not surprising, BX004 maintained an excellent safety and tolerability profile with no treatment-related adverse effect observed in the study. Phage-based treatment are generally regarded as safe and results on the study serve to reinforce this view, providing us with additional comfort that BX004 can be administered at a higher dose and over a longer treatment period as specified in Part 2 of the CF study. Phage were detectable in several BX004 treated patients up to Day 15 or one week after the end of the seven-day treatment period, and there’s no emerging resistance to BX004 during or after treatment. As expected, there was no change in lung function as measured by FEV1, which we attribute to the shorter course of therapy specified in Part 1 of the study.

In summary, we believe BX004 is emerging as one of the most promising development phage therapies for treatment of chronic PsA infections in patients with cystic fibrosis. In canvasing both the development phage landscape and the compassionate use program, BX004 appears to be highly competitive with respect to a number of key product attributes, including safety, tolerability and reducing pathogenic bacteria. In addition, we also believe BX004 to be further differentiated from its potential to address resistant strain of PsA given its unique design to confer orthogonal based coverage across pathogenic strains. I’d now like to turn the call over to Marina to review our financial results for the full year 2022.

Marina Wolfson: Thank you, Jonathan. As a reminder, the financial information is available in the press release we issued earlier today and also in more detail in our Form 10-K, which will be filed later today. I will walk you through some of our brief highlights. As of December 31, 2022, cash balance and short-term deposits were $34.3 million compared to $63.1 million as of December 31, 2021. The decrease was primarily due to net cash used in operating activities. R&D expenses net were $16.2 million, down from $22.7 million for the previous year, mainly because of reduced salaries, stock-based compensation and workforce reduction resulting from corporate restructuring. Additionally, the decrease was a result of discontinuing, pausing and delaying the development of several programs.

General and administrative expenses were $9.5 million for 2022 compared to $11.3 million for the prior year. The decrease was primarily due to a decrease in salaries and related expenses and stock-based compensation due to a reduction in workforce as well as a decrease in recruitment and employee-related expenses, all resulting from corporate restructuring. Net loss for 2022 was $28.3 million compared to $36.2 million for the prior year. Net cash used in operating activities for 2022 was $29.1 million compared to $27.6 million for the same period in 2021. We estimate that existing cash, cash equivalents and short-term deposits will be sufficient to fund the company’s current operating plan through at least middle of 2024. And now I’ll turn the call back over to Jonathan for his closing remarks.

Jonathan?

Jonathan Solomon: Thank you, Marina. As I mentioned at the beginning of today’s call, I believe BiomX is posed for an outstanding 2023. Despite continued challenges in the capital markets, we are well positioned based on potentially best-in-class BX004 product candidates in CF, a strong balance sheet and support from our current investors, including the Cystic Fibrosis Foundation. Immediately following the release of Part 1 data, BiomX was also able to raise additional capital from our existing shareholders. We very much value and appreciate the support as these additional funds reflect the growing optimism surrounding our BX004 program. In our view, funding remains viable for those companies with product candidates that can demonstrate robust clinical data leading to best-in-class potential.

We believe BX004 clearly fits this profile. We couldn’t be more pleased with the progress we continue to make and bring this potentially life-saving therapy to CF patients. And we look forward to reporting our Part 2 results in the third quarter of this year. With that, Marina and I would be happy to take any of your questions. Operator?

See also 10 Cheap Jim Cramer Stocks to Buy and 12 Best Diversified Dividend Stocks to Buy Now.

Q&A Session

Follow Biomx Inc. (AMEX:PHGE)

Follow Biomx Inc. (AMEX:PHGE)

Receive real-time insider trading and news alerts

Operator: Thank you. Our first question has come from the line of Joe Pantginis with H.C. Wainwright. Please proceed with your questions.

Joe Pantginis: Hey there, Jonathan and Marina, thanks for taking the question. So first, a quick question on the Part 1 data. Just curious, as we’re moving into Part 2, will we be receiving any longer-term follow-up from the Part 1 patients?

Jonathan Solomon: Joe and good morning. there is a bit more data that will come out in Part 1, analyzing some of the samples and the follow-ups. We are planning to present at a conference or a paper. So once we have confirmation on that, we’ll give you guidance on it.

Joe Pantginis: Got it. And then I guess, a little bit of nuance and impact of Part 1 on the Part 2 data or I’m sorry, the Part 2 section of the study. So first, following the announcement of these data, is there any feedback you can provide as to impact on, say, Part 2 enrollment kinetics and as well as any additional interest by new physicians for Part 2? And do any of the physicians require any additional training or education to conduct Part 2 relative to Part 1?

Jonathan Solomon: Joe, it’s an excellent question. I mean there is quite a lot of excitement sharing it with the PIs, our supporters of the CF Foundation with the state . It’s quite dramatic. As we said, right, we weren’t expecting this level of bacterial reduction and the quality of the data that we’ve seen in Part 1, which was basically an initial safety study. So it definitely took us by surprise, a pleasant surprise that is. It is helping with communication. I think there’s a lot more PIs that are excited, patients as well. We want to be conservative, and I think we’re keeping the same guidance that we provided in the past, but things are definitely on track, a lot more incoming, and also bear in mind that the Part 2 is sort of not as intense on the patients. They’re not required to come in every day. So there’s definitely, we get the sense that there’s more comfort; there’s more excitement with participating in the Part 2.

Joe Pantginis: That’s really helpful. And then maybe just one last checkbox question, if you don’t mind, just making sure about the manufacturing status for BX004 for not only Part 2, but steps beyond?

Jonathan Solomon: Yes. So it’s a question we spent some time talking, right, and I think it’s still kind of paying dividends, the decision we took two years to kind of put everything in-house. So it’s looking good. It’s all under our control and pretty straightforward. The cocktail sort of was optimized among other parameters for relative ease of manufacturing. So we do feel very confident with supplies through the Part 2, and now kind of starting to think about pivotal studies and requirements, yes, the GMP requirement for a pivotal study. So that’s some of the work that we’re now starting to do.

Joe Pantginis: Got it. Thank you.

Jonathan Solomon: You bet, pleasure.

Operator: Thank you. Our next question has come from the line of Michael Higgins with Ladenburg Thalmann. Please proceed with your questions.

Unidentified Analyst: Good morning. This is Sahana on behalf of Michael. Congrats on the quarter. We have two questions. The first one relates to Part 2, I think, Jonathan, you had mentioned when the Part 1 results came that they could provide some like could generate some changes to Part 2. So we were just wondering if any changes were made yet? And the second question is what is the guidance on BX003? Thank you.