In this article, we discuss Ken Fisher’s performance in 2021 and the 15 best performing stocks in his portfolio. If you want to skip our detailed analysis of these stocks, go directly to Ken Fisher’s Performance in 2021: 5 Best Performing Stocks.

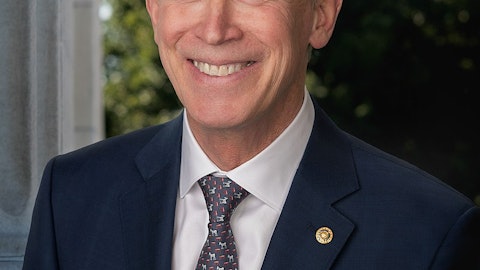

On January 14, Ken Fisher, the chief of Fisher Asset Management, released a video on his Youtube channel taking a look back at the performance of the stock market in 2021. Fisher dubbed 2021 a “pretty darn good year” for everybody “except the bears”, noting that growth stocks had performed better than value equities but not by much, thus offering something to investors of all kinds. Ken Fisher is one of the most successful investors on Wall Street and one of the richest men in the world with a personal net worth of close to $6 billion.

Summing up 2021, Fisher explained how the year started with a lot of optimism around the economic recovery and a flurry of SPAC-backed IPOs, a “euphoria” that faded as concerns around inflation, interest rate hikes, emergence of new virus variants, and politics overshadowed the bull market. The veteran investor, whose top holdings are concentrated in the in the technology and healthcare sectors, added that the year now seems “optimistic overall” and “no longer euphoric” but built a base that “has the potential to endure”.

Some of the stocks in the portfolio of Fisher Asset Management at the end of September included Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Alphabet Inc. (NASDAQ:GOOG), among others discussed in detail below.

Our Methodology

The companies listed below were picked from the investment portfolio of Fisher Asset Management at the end of the third quarter of 2021. The stocks have been sorted based on the gains in their share price over 2021.

Data from around 900 elite hedge funds tracked by Insider Monkey was used to identify the number of hedge funds that hold stakes in each firm.

Ken Fisher’s Performance in 2021: Best Performing Stocks

15. PerkinElmer, Inc. (NYSE:PKI)

Number of Hedge Fund Holders: 31

Gain in Share Price in 2021: 36%

PerkinElmer, Inc. (NYSE:PKI) markets life sciences tools and services. Major hedge funds have been exceedingly bullish on the stock in recent months. Among the hedge funds being tracked by Insider Monkey, New York-based investment firm Select Equity Group is a leading shareholder in PerkinElmer, Inc. (NYSE:PKI) with 7.4 million shares worth more than $1.2 billion.

PerkinElmer, Inc. (NYSE:PKI) has featured in the Fisher portfolio, with minor exceptions, since the first quarter of 2012. The present holding, purchased in the fourth quarter of 2013, consists of more than 63,000 shares worth over $10 million. The highest number of PerkinElmer, Inc. (NYSE:PKI) shares held by Fisher since 2012 stands at around 697,000.

Just like Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Alphabet Inc. (NASDAQ:GOOG), PerkinElmer, Inc. (NYSE:PKI) is one of the notable stock picks of Ken Fisher.

14. Ford Motor Company (NYSE:F)

Number of Hedge Fund Holders: 51

Gain in Share Price in 2021: 97%

Ford Motor Company (NYSE:F) makes and sells automotives. Fisher first purchased a stake in Ford Motor Company (NYSE:F) during the fourth quarter of 2010, buying nealy 24,000 shares at an average price of $15.49 per share. The stock has since featured consistently in the fund’s portfolio. In the fourth quarter of 2013, Fisher owned nearly 1.6 million shares of Ford Motor Company (NYSE:F) but has since steadily decreased that stake. At the end of September, the fund owned over 86,000 shares of Ford Motor Company (NYSE:F) worth $1.2 million.

Ford Motor Company (NYSE:F) has attracted the interest of several elite hedge funds as it ramps up investments in electric vehicles. At the end of the third quarter of 2021, 51 hedge funds in the database of Insider Monkey held stakes worth $1.6 billion in Ford Motor Company (NYSE:F).

In its Q1 2020 investor letter, Greenlight Capital Fund, an asset management firm, highlighted a few stocks and Ford Motor Company (NYSE:F) was one of them. Here is what the fund said:

“General Motors (GM) was a disappointment. The damage from last year’s strike consumed most of the cash flow GM would have otherwise generated in 2019. We had expected a strong bounce back in earnings and cash flow in 2020, but the annual guidance, while meeting Wall Street expectations, was worse than we expected. Further, the cash burned during the strike needed to be re-earned in order to protect GM’s investment grade rating. Pre-crisis, there would have been, at best, a minimal share repurchase late in the year. At the analyst day, our hopes that 2020 would finally be the year were dashed. We sold our stock. Over our five-year holding period, we made a 9.6% IRR on GM. In the difficult environment, its most comparable peer, Ford Motor Company (NYSE:F), lost about half its value.”

13. MYR Group Inc. (NASDAQ:MYRG)

Number of Hedge Fund Holders: 16

Gain in Share Price in 2021: 98%

MYR Group Inc. (NASDAQ:MYRG) provides electrical transmission and distribution services. Top hedge funds have displayed increased interest in the company as it offers a healthy mix of growth and value to investors. At the end of the third quarter of 2021, 16 hedge funds in the database of Insider Monkey held stakes worth $73 million in MYR Group Inc. (NASDAQ:MYRG), up from 13 in the previous quarter worth $90 million.

During the third quarter of 2021, Fisher Asset Management increased its stake in MYR Group Inc. (NASDAQ:MYRG) by 30% compared to filings for the second quarter, taking the total number of shares it owns in the company to more than 36,000. These shares are worth more than $3.6 million. MYR Group Inc. (NASDAQ:MYRG) has featured consistently in the Fisher portfolio since the third quarter of 2015 with an exception in the third quarter of 2017.

In its Q2 2021 investor letter, Third Avenue Management, an asset management firm, highlighted a few stocks and MYR Group Inc. (NASDAQ:MYRG) was one of them. Here is what the fund said:

“The Fund’s compounder bucket includes companies such as MYR Group Inc. (NASDAQ:MYRG) (engineering and construction). We believe balance sheet strength and prudent capital allocation should allow these companies to compound NAV for many years to come. Financial services companies are roughly one third of the compounder category and are largely comprised of well-capitalized regional banks which make up 21% of the portfolio.”

12. ServisFirst Bancshares, Inc. (NYSE:SFBS)

Number of Hedge Fund Holders: 8

Gain in Share Price in 2021: 106%

ServisFirst Bancshares, Inc. (NYSE:SFBS) operates as a bank holding firm. Fisher has been a long-term admirer of the stock. He first purchased a stake in ServisFirst Bancshares, Inc. (NYSE:SFBS) in the third quarter of 2015, buying nearly 150,000 shares at an average price of $19.51 per share. He then added to this position before selling off the entire stake in the third quarter of 2017. In the fourth quarter, he opened a new position. This stake has been a mainstay in the portfolio and consists of over 49,000 shares worth $3.8 million.

As the Fed prepares to raise interest rates, many hedge funds see bank stocks like ServisFirst Bancshares, Inc. (NYSE:SFBS) as a solid bet for the near term. At the end of the third quarter of 2021, 8 hedge funds in the database of Insider Monkey held stakes worth $11 million in ServisFirst Bancshares, Inc. (NYSE:SFBS).

In its Q3 2021 investor letter, FPA Queens Road, an asset management firm, highlighted a few stocks and ServisFirst Bancshares, Inc. (NYSE:SFBS) was one of them. Here is what the fund said:

“ServisFirst Bancshares, Inc. (NYSE:SFBS), a full-service commercial bank, announced during the quarter that both deposits and book value grew 17% from the previous year. The growth in book value is in line with its long-term average. One of the largest holdings in our portfolio, we remain confident in the company’s long-term prospects.”

11. Earthstone Energy, Inc. (NYSE:ESTE)

Number of Hedge Fund Holders: 11

Gain in Share Price in 2021: 112%

Earthstone Energy, Inc. (NYSE:ESTE) is an independent oil and gas firm. With energy prices at record highs and demand increasing, institutional investors have been piling into the stock in hopes of benefiting from this boom. At the end of the third quarter of 2021, 11 hedge funds in the database of Insider Monkey held stakes worth $19 million in Earthstone Energy, Inc. (NYSE:ESTE), up from 9 in the previous quarter worth $23 million.

Earthstone Energy, Inc. (NYSE:ESTE) is a relatively new addition to the portfolio of Fisher Asset Management. The fund first purchased a stake in Earthstone Energy, Inc. (NYSE:ESTE) during the second quarter of 2021, buying nearly 100,000 shares at an average price of $9.08 per share. Fisher then proceeded to add to that position by 28% during the third quarter. The fund presently holds 127,647 shares of Earthstone Energy, Inc. (NYSE:ESTE) worth $1.1 million.

10. Boot Barn Holdings, Inc. (NYSE:BOOT)

Number of Hedge Fund Holders: 28

Gain in Share Price in 2021: 114%

Boot Barn Holdings, Inc. (NYSE:BOOT) owns and runs specialty retail stores. At the end of September, the hedge fund led by Fisher owned 12,811 shares of Boot Barn Holdings, Inc. (NYSE:BOOT) worth $1.1 million. The fund, per official data, increased a previously-held stake in Boot Barn Holdings, Inc. (NYSE:BOOT) by 33% during the third quarter.

Boot Barn Holdings, Inc. (NYSE:BOOT) has also been on the radar of other elite hedge funds as a pullback in share price allows for a more attractive entry point. At the end of the third quarter of 2021, 28 hedge funds in the database of Insider Monkey held stakes worth $246 million in Boot Barn Holdings, Inc. (NYSE:BOOT).

In its Q2 2021 investor letter, Wasatch Global Investors, an asset management firm, highlighted a few stocks and Boot Barn Holdings, Inc. (NYSE:BOOT) was one of them. Here is what the fund said:

“Boot Barn Holdings, Inc. (NYSE:BOOT) was also a large contributor. Boot Barn Holdings, Inc. (NYSE:BOOT) is a specialty retailer offering increasingly popular Western and work-related apparel, footwear and accessories. Boots are somewhat resistant to online competition because they often require specialized fitting. Boot Barn Holdings, Inc. (NYSE:BOOT) has benefited from its economies of scale and multi-channel business model, which kept revenues flowing during virus-related shutdowns. Stimulus payments by the federal government to consumers appear to have helped as well. Boot Barn’s private-label brands, built around wellknown personalities in the music business, have enabled the company to convert higher portions of its sales revenues into bottom-line profits.”

9. Dynavax Technologies Corporation (NASDAQ:DVAX)

Number of Hedge Fund Holders: 19

Gain in Share Price in 2021: 122%

Dynavax Technologies Corporation (NASDAQ:DVAX) is a biopharma firm focusing on the development of novel vaccines. A growing number of hedge funds have turned bullish towards the stock in recent months. At the end of the third quarter of 2021, 19 hedge funds in the database of Insider Monkey held stakes worth $397 million in Dynavax Technologies Corporation (NASDAQ:DVAX), up from 15 in the previous quarter worth $101 million.

Although Dynavax Technologies Corporation (NASDAQ:DVAX) has featured in the Fisher portfolio since early 2018, the billionaire has limited that position to around 50,000 shares. However, during the second quarter of 2021, after selling off the previous stake entirely in 2020, Fisher opened a new position in Dynavax Technologies Corporation (NASDAQ:DVAX) worth over 2.2 million shares. He then proceeded to increase his exposure to the stock by nearly 50% during the third quarter. The fund presently owns over 3.3 million shares of Dynavax Technologies Corporation (NASDAQ:DVAX) worth more than $63 million.

8. Builders FirstSource, Inc. (NYSE:BLDR)

Number of Hedge Fund Holders: 53

Gain in Share Price in 2021: 124%

Builders FirstSource, Inc. (NYSE:BLDR) markets building products. Fisher first purchased a stake in Builders FirstSource, Inc. (NYSE:BLDR) during the fourth quarter of 2017. He has since added to that position and the stock has featured in the Fisher portfolio consistently. At the end of September, the fund owned 190,754 shares of Builders FirstSource, Inc. (NYSE:BLDR) worth $9.8 million.

As Builders FirstSource, Inc. (NYSE:BLDR) posts market-beating earnings, hedge funds have started turning bullish on the stock. Among the hedge funds being tracked by Insider Monkey, Connecticut-based investment firm Coliseum Capital is a leading shareholder in Builders FirstSource, Inc. (NYSE:BLDR) with 8.9 million shares worth more than $460 million.

In its Q3 2021 investor letter, Merion Road Capital Management, an asset management firm, highlighted a few stocks and Builders FirstSource, Inc. (NYSE:BLDR) was one of them. Here is what the fund said:

“I added to our position in Builders FirstSource, Inc. (NYSE:BLDR) during the quarter. Builders FirstSource, Inc. (NYSE:BLDR) is the largest national supplier of structural building products and value-added components to the residential construction market. They have been active in consolidating the industry, most notably with the merger of BMC earlier this year. Like other distributors, Builders FirstSource, Inc. (NYSE:BLDR) benefits from scale advantages that afford them a robust product offering, enhanced purchasing power, and fixed cost leverage. They will continue to acquire smaller competitors and have announced 5 new deals so far this year.

I view the strategic benefit of these acquisitions in three different buckets. There are the core tuck-in acquisitions of facilities and customer lists that increase scale and geographic reach. An example would be the company’s May acquisition of John’s Lumber, a lumber and specialty product distributor serving the Detroit MSA, at 0.5x revenue. There are product acquisitions that leverage their platform to increase distribution and improve the product offering. For instance, last month BLDR announced the acquisition of California TrusFrame, a designer and manufacturer of prefabricated components like trusses and wall panels, at 1.3x revenue. And lastly BLDR has begun investing in software and services. In June they spent $450mm on the purchase of WTS Paradigm, a software company that addresses the complexity around building configuration, estimating, and manufacturing, at 9.0x revenue. By utilizing software to in the planning process, WTS Paradigm cuts down on material and labor waste, ensures an optimal fit of product and design, and eases the contractor’s workload. Builders FirstSource, Inc. (NYSE:BLDR) has followed this up with a much smaller software acquisition in September.

Builders FirstSource, Inc. (NYSE:BLDR) is in the very early innings of their software investment, so it is difficult to pinpoint exactly how it will impact the company in the coming years. Management believes that there is a lot of low hanging fruit, pointing to a McKinsey study ranking the construction industry as second to last on overall digitization. If anyone has had any work done to their house, I am sure they can anecdotally attest to this. BLDR plans to leverage WTS Paradigm to increase internal productivity (i.e. improved estimating leading to fewer visits to the job site), cross-sell the software to existing clients, and drive greater adoption of value-added products. So thinking a few years out I think the goal would be to have higher margins on their commodity business, a greater mix of revenue coming from value added products, a stronger relationship with their customer, and an enhanced competitive advantage…” (Click here to see the full text)

7. PDC Energy, Inc. (NASDAQ:PDCE)

Number of Hedge Fund Holders: 20

Gain in Share Price in 2021: 124%

PDC Energy, Inc. (NASDAQ:PDCE) is a Colorado-based energy firm. Elite hedge funds have backed PDC Energy, Inc. (NASDAQ:PDCE) to deliver solid returns in 2022. Among the hedge funds being tracked by Insider Monkey, Chicago-based investment firm Harris Associates is a leading shareholder in PDC Energy, Inc. (NASDAQ:PDCE) with 2.4 million shares worth more than $116 million.

PDC Energy, Inc. (NASDAQ:PDCE) has been among the top stocks in the Fisher Asset Management portfolio since the first quarter of 2020. At the end of September, the fund owned over 1.4 million shares of PDC Energy, Inc. (NASDAQ:PDCE) worth $69 million, representing 0.04% of the portfolio.

6. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 83

Gain in Share Price in 2021: 126%

NVIDIA Corporation (NASDAQ:NVDA) operates as a visual computing firm. Although Fisher first bought a stake in the company in late 2010, there was a long period between 2013 and 2018 that NVIDIA Corporation (NASDAQ:NVDA) did not feature prominently in his portfolio. This changed in late 2018 as Fisher increased exposure to the stock in line with the rise of NVIDIA Corporation (NASDAQ:NVDA) at the market. At the end of September, the fund owned over 4.8 million shares of NVIDIA Corporation (NASDAQ:NVDA) worth more than $1 billion.

NVIDIA Corporation (NASDAQ:NVDA) stock has generated lots of buzz in the hedge fund industry as chip prices skyrocket. At the end of the third quarter of 2021, 83 hedge funds in the database of Insider Monkey held stakes worth $10 billion in NVIDIA Corporation (NASDAQ:NVDA).

Alongside Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Alphabet Inc. (NASDAQ:GOOG), NVIDIA Corporation (NASDAQ:NVDA) is one of the stocks that hedge funds are buying.

In its Q1 2021 investor letter, Vulcan Value Partners, an asset management firm, highlighted a few stocks and NVIDIA Corporation (NASDAQ:NVDA) was one of them. Here is what the fund said:

“NVIDIA Corporation (NASDAQ:NVDA) is the dominant supplier of Graphics Processing Units (GPUs) worldwide. NVIDIA’s GPUs are at the intersection of a number of important computing trends including the movement to the Cloud, artificial intelligence, autonomous vehicles, edge computing, gaming, and more. We previously owned NVIDIA Corporation (NASDAQ:NVDA) and sold it in the third quarter of 2020 as the price to value gap closed and our margin of safety was reduced. As with all our MVP companies, we continued to follow NVIDIA Corporation (NASDAQ:NVDA) closely. Since that time, NVIDIA reported excellent results and its value has compounded rapidly. The technology selloff at the beginning of the year negatively affected the stock price while our estimate of NVIDIA’s value per share increased. This happy combination of events created a margin of safety and an opportunity to once again add NVIDIA Corporation (NASDAQ:NVDA) to the portfolio.”

Click to continue reading and see Ken Fisher’s Performance in 2021: 5 Best Performing Stocks.

Suggested Articles:

- 10 NFT Startups Investors are Flocking To

- 12 Best Airline Stocks To Invest In Right Now

- 10 Stocks Jim Cramer Is Recommending

Disclosure. None. Ken Fisher’s Performance in 2021: 15 Best Performing Stocks is originally published on Insider Monkey.