The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 866 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2020. What do these smart investors think about Axalta Coating Systems Ltd (NYSE:AXTA)?

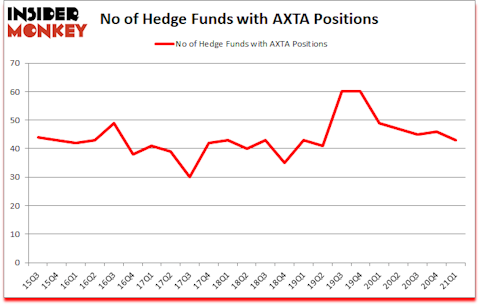

Axalta Coating Systems Ltd (NYSE:AXTA) has experienced a decrease in hedge fund sentiment of late. Axalta Coating Systems Ltd (NYSE:AXTA) was in 43 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 60. There were 46 hedge funds in our database with AXTA holdings at the end of December. Our calculations also showed that AXTA isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Today there are a large number of formulas stock traders put to use to analyze their stock investments. A duo of the less known formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the top hedge fund managers can beat the market by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

John Rogers of Ariel Investments

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the latest hedge fund action surrounding Axalta Coating Systems Ltd (NYSE:AXTA).

Do Hedge Funds Think AXTA Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the fourth quarter of 2020. The graph below displays the number of hedge funds with bullish position in AXTA over the last 23 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Berkshire Hathaway was the largest shareholder of Axalta Coating Systems Ltd (NYSE:AXTA), with a stake worth $410.8 million reported as of the end of March. Trailing Berkshire Hathaway was Rivulet Capital, which amassed a stake valued at $189.2 million. Citadel Investment Group, Ariel Investments, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Rivulet Capital allocated the biggest weight to Axalta Coating Systems Ltd (NYSE:AXTA), around 10.26% of its 13F portfolio. MD Sass is also relatively very bullish on the stock, designating 5.69 percent of its 13F equity portfolio to AXTA.

Seeing as Axalta Coating Systems Ltd (NYSE:AXTA) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there were a few fund managers who sold off their entire stakes heading into Q2. Intriguingly, David Rosen’s Rubric Capital Management dropped the largest investment of the “upper crust” of funds tracked by Insider Monkey, totaling about $34.3 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund sold off about $32.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds heading into Q2.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Axalta Coating Systems Ltd (NYSE:AXTA) but similarly valued. We will take a look at Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR), Redfin Corporation (NASDAQ:RDFN), Hanesbrands Inc. (NYSE:HBI), Ballard Power Systems Inc. (NASDAQ:BLDP), MINISO Group Holding Limited (NYSE:MNSO), GW Pharmaceuticals plc (NASDAQ:GWPH), and Post Holdings Inc (NYSE:POST). This group of stocks’ market valuations are closest to AXTA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARWR | 20 | 151598 | -4 |

| RDFN | 18 | 434551 | -3 |

| HBI | 32 | 977516 | 5 |

| BLDP | 18 | 125641 | -2 |

| MNSO | 12 | 87616 | -6 |

| GWPH | 40 | 2735520 | 23 |

| POST | 33 | 1567551 | 6 |

| Average | 24.7 | 868570 | 2.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.7 hedge funds with bullish positions and the average amount invested in these stocks was $869 million. That figure was $1563 million in AXTA’s case. GW Pharmaceuticals plc (NASDAQ:GWPH) is the most popular stock in this table. On the other hand MINISO Group Holding Limited (NYSE:MNSO) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Axalta Coating Systems Ltd (NYSE:AXTA) is more popular among hedge funds. Our overall hedge fund sentiment score for AXTA is 73.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still managed to beat the market by 6.1 percentage points. Hedge funds were also right about betting on AXTA, though not to the same extent, as the stock returned 4.7% since the end of March (through June 18th) and outperformed the market as well.

Follow Axalta Coating Systems Ltd. (NYSE:AXTA)

Follow Axalta Coating Systems Ltd. (NYSE:AXTA)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Hydrogen Fuel Cell Stocks To Buy Now

- 20 Most Diverse Cities in the US

Disclosure: None. This article was originally published at Insider Monkey.