After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Autodesk, Inc. (NASDAQ:ADSK).

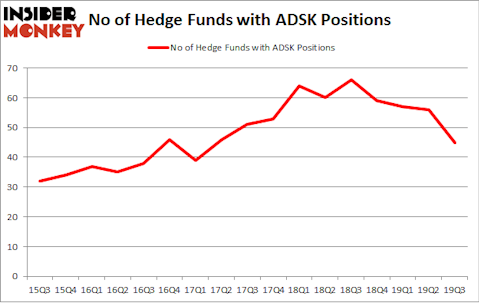

Is Autodesk, Inc. (NASDAQ:ADSK) a buy right now? The best stock pickers are in a pessimistic mood. The number of long hedge fund bets dropped by 11 recently. Our calculations also showed that ADSK isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

John Armitage of Egerton Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the latest hedge fund action surrounding Autodesk, Inc. (NASDAQ:ADSK).

How have hedgies been trading Autodesk, Inc. (NASDAQ:ADSK)?

At the end of the third quarter, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ADSK over the last 17 quarters. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in Autodesk, Inc. (NASDAQ:ADSK) was held by Lone Pine Capital, which reported holding $665.8 million worth of stock at the end of September. It was followed by Two Sigma Advisors with a $261.7 million position. Other investors bullish on the company included Darsana Capital Partners, Egerton Capital Limited, and Steadfast Capital Management. In terms of the portfolio weights assigned to each position HMI Capital allocated the biggest weight to Autodesk, Inc. (NASDAQ:ADSK), around 13.92% of its portfolio. Darsana Capital Partners is also relatively very bullish on the stock, setting aside 9.17 percent of its 13F equity portfolio to ADSK.

Seeing as Autodesk, Inc. (NASDAQ:ADSK) has witnessed falling interest from the aggregate hedge fund industry, we can see that there is a sect of fund managers that elected to cut their entire stakes last quarter. It’s worth mentioning that Daniel S. Och (founder)’s Sculptor Capital sold off the largest stake of all the hedgies followed by Insider Monkey, comprising an estimated $190 million in stock, and Zach Schreiber’s Point State Capital was right behind this move, as the fund dumped about $54.5 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 11 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Autodesk, Inc. (NASDAQ:ADSK) but similarly valued. We will take a look at China Unicom (Hong Kong) Limited (NYSE:CHU), Shopify Inc (NYSE:SHOP), Equity Residential (NYSE:EQR), and Advanced Micro Devices, Inc. (NASDAQ:AMD). This group of stocks’ market valuations resemble ADSK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHU | 8 | 65922 | 2 |

| SHOP | 34 | 2509650 | 8 |

| EQR | 23 | 196497 | 0 |

| AMD | 56 | 1135132 | 15 |

| Average | 30.25 | 976800 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $977 million. That figure was $2728 million in ADSK’s case. Advanced Micro Devices, Inc. (NASDAQ:AMD) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (NYSE:CHU) is the least popular one with only 8 bullish hedge fund positions. Autodesk, Inc. (NASDAQ:ADSK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on ADSK as the stock returned 13.1% during the fourth quarter (through 11/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.