We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Astronics Corporation (NASDAQ:ATRO).

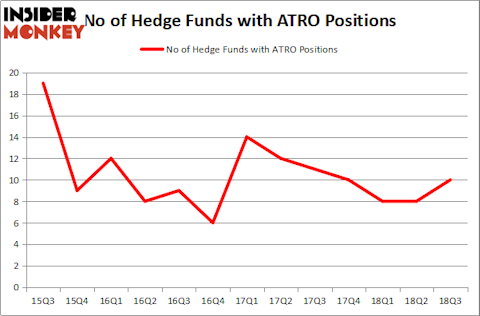

Astronics Corporation (NASDAQ:ATRO) investors should be aware of an increase in enthusiasm from smart money recently. ATRO was in 10 hedge funds’ portfolios at the end of September. There were 8 hedge funds in our database with ATRO positions at the end of the previous quarter. Our calculations also showed that ATRO isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action regarding Astronics Corporation (NASDAQ:ATRO).

How have hedgies been trading Astronics Corporation (NASDAQ:ATRO)?

Heading into the fourth quarter of 2018, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in ATRO at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, ACK Asset Management was the largest shareholder of Astronics Corporation (NASDAQ:ATRO), with a stake worth $42.8 million reported as of the end of September. Trailing ACK Asset Management was International Value Advisers, which amassed a stake valued at $17.4 million. Millennium Management, Citadel Investment Group, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers have jumped into Astronics Corporation (NASDAQ:ATRO) headfirst. Millennium Management, managed by Israel Englander, established the most outsized position in Astronics Corporation (NASDAQ:ATRO). Millennium Management had $6 million invested in the company at the end of the quarter. Alec Litowitz and Ross Laser’s Magnetar Capital also initiated a $0.2 million position during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Astronics Corporation (NASDAQ:ATRO). These stocks are Atkore International Group Inc. (NYSE:ATKR), First Trust Developed Markets Ex-US AlphaDEX Fund (NASDAQ:FDT), Materion Corp (NYSE:MTRN), and Southside Bancshares, Inc. (NASDAQ:SBSI). All of these stocks’ market caps match ATRO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATKR | 24 | 151269 | 3 |

| FDT | 1 | 7076 | -1 |

| MTRN | 13 | 98223 | -2 |

| SBSI | 9 | 67248 | -1 |

| Average | 11.75 | 80954 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $81 million. That figure was $75 million in ATRO’s case. Atkore International Group Inc. (NYSE:ATKR) is the most popular stock in this table. On the other hand First Trust Developed Markets Ex-US AlphaDEX Fund (NASDAQ:FDT) is the least popular one with only 1 bullish hedge fund positions. Astronics Corporation (NASDAQ:ATRO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ATKR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.