We came across a bullish thesis on ASML Holding N.V. (ASML) on Monopolistic Investor’s Substack. In this article, we will summarize the bulls’ thesis on ASML. ASML Holding N.V. (ASML)’s share was trading at $746.51 as of 28th May. ASML’s trailing and forward P/E were 29.62 and 27.47 respectively according to Yahoo Finance.

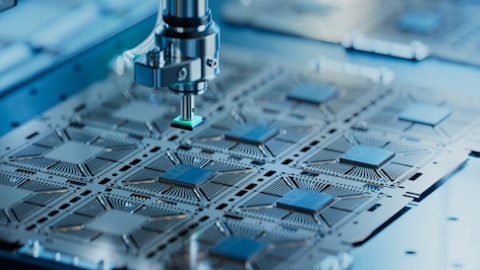

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

ASML, a Dutch company, plays a critical but often understated role in the semiconductor industry by producing the highly complex extreme ultraviolet (EUV) lithography machines essential for manufacturing the world’s most advanced chips. Its technology works by generating EUV light through an intricate process involving vaporized tin droplets and lasers inside a vacuum chamber, with precision-engineered multilayer mirrors and reticles transferring chip patterns onto silicon wafers with extraordinary accuracy. The company’s machines operate with near-perfect environmental controls, managing temperature within thousandths of a degree and positioning wafers with micrometer precision, reflecting an unparalleled level of engineering sophistication that is extremely difficult for competitors to replicate.

Despite holding significant pricing power, ASML chooses not to excessively raise prices, balancing profitability with the broader goal of supporting ongoing research and innovation in the tech ecosystem, maintaining around 50% gross margins. The Dutch government recognizes ASML’s strategic importance and supports its growth through initiatives like Project Beethoven, aimed at expanding infrastructure and preserving jobs domestically as ASML expands globally. This combination of technological leadership, prudent pricing, and strong governmental backing positions ASML as a vital, resilient player in the semiconductor supply chain, underpinning the future of advanced computing technologies.

Previously, we have covered ASML Holdings N.V. (ASML) in May 2025 wherein we summarized a bullish thesis by FluentInQuality on Substack. The author highlighted the company as the sole global provider of extreme ultraviolet (EUV) lithography machines, essential for producing the world’s most advanced semiconductors. It emphasized ASML’s unmatched technological moat, strong financials with high margins and return on invested capital, and significant geopolitical importance, positioning the company as a critical bottleneck in the semiconductor supply chain. Since our last coverage, the stock is up 10.96%.

ASML Holding N.V. (ASML) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 80 hedge fund portfolios held ASML at the end of the first quarter which was 86 in the previous quarter. While we acknowledge the risk and potential of ASML as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than ASML but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.