Renaissance Investment Management, an investment management company, released its “Large Cap Growth Strategy” third quarter investor letter. A copy of the same can be downloaded here. In the third quarter, the strategy returned -3.46% (net) compared to a -3.60% return for the Russell 1000 Growth Index and -4.88% return for the S&P 500 Index. The focus on high-quality stocks led the strategy to outperform the indexes in the quarter. The Consumer Discretionary sector significantly contributed to the strategy’s performance while the Technology sector detracted from the performance. In addition, please check the fund’s top five holdings to know its best picks in 2022.

Renaissance Investment highlighted stocks like Lam Research Corporation (NASDAQ:LRCX) in its Q3 2022 investor letter. Headquartered in Fremont, California, Lam Research Corporation (NASDAQ:LRCX) is a semiconductor equipment processing company. On December 27, 2022, Lam Research Corporation (NASDAQ:LRCX) stock closed at $405.46 per share. One-month return of Lam Research Corporation (NASDAQ:LRCX) was -14.17%, and its shares lost 44.21% of their value over the last 52 weeks. Lam Research Corporation (NASDAQ:LRCX) has a market capitalization of $55.296 billion.

Renaissance Investment made the following comment about Lam Research Corporation (NASDAQ:LRCX) in its Q3 2022 investor letter:

“Conversely, we sold our positions in Lam Research Corporation (NASDAQ:LRCX) and Zoetis (ZTS) following a sustained deterioration in fundamental factors. After a qualitative review of Lam Research, we believe the company will face a number of headwinds that could make for an unfavorable risk-reward position, given the highly cyclical nature of its business in a slowing global economy. We are also expecting fundamentals to turn negative as sales and operating profits are poised to decelerate, resulting in negative earnings revisions. While the stock trades at an attractive valuation multiple, we believe that this is more a sign that earnings will decline meaningfully.”

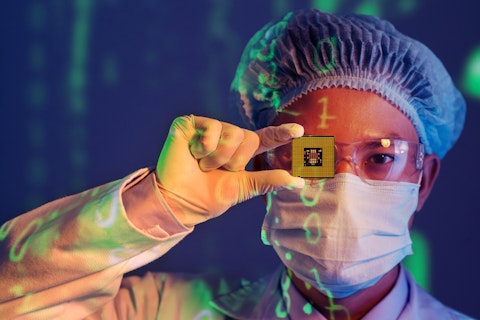

Dragon Images/Shutterstock.com

Lam Research Corporation (NASDAQ:LRCX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 63 hedge fund portfolios held Lam Research Corporation (NASDAQ:LRCX) at the end of the third quarter, which was 56 in the previous quarter.

We discussed Lam Research Corporation (NASDAQ:LRCX) in another article and shared the list of largest semiconductor companies by market capitalization. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 10 Best Advertising Technology Stocks To Buy

- 11 Best Agriculture Stocks To Buy Now

- 11 Best Small Cap AI Stocks To Buy

Disclosure: None. This article is originally published at Insider Monkey.