Will the $47B NXP Semiconductors NV (NASDAQ:NXPI) buyout hurt QUALCOMM, Inc. (NASDAQ:QCOM)’s future dividend payouts?

– Qualcomm has a healthy balance sheet that will allow it to sustain dividends comfortably for the next few years.

– The acquisition of NXP won’t change any of that.

– Qualcomm is merely going to use its idle cash lying in foreign countries to fund the buyout.

QUALCOMM, Inc. (NASDAQ:QCOM) has been a long-time favorite amongst dividend growth investors thanks to its steady stock appreciation and ever-increasing annual dividend payouts over the past decade. But after the chipmaker announced its acquisition of NXP Semiconductors NV (NASDAQ:NXPI) for $38 billion, it’s only natural to question whether its dividend payouts will be sustainable in the future or not. So let’s take a closer look at Qualcomm’s financial position to have a better understanding of it all.

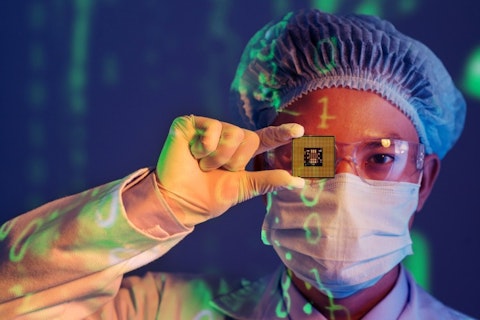

Dragon Images/Shutterstock.com

The Finances

Let’s start by looking at Qualcomm’s financial position. This is an important step in dividend sustainability analysis as it provides insights about whether the company would need to borrow funds to maintain its payout or not. Companies that are struggling in their operations and are highly leveraged are most likely to slash their dividends or raise debt to sustain their dividend payouts. (See also: Is Qualcomm Inc (QCOM) Stock A Better Bet Than Intel Corporation (INTC) Stock?)

Coming back to Qualcomm, its overall debt aggregates to about $11.7 billion (1). The debt figure might look lofty at first but it’s well under control as the chipmaker’s total stock holder’s equity stands at over $31.7 billion. This equates to a debt/equity ratio of a modest 37% only. This isn’t considered high by any means, suggesting that Qualcomm isn’t reeling under debt. Avid readers and Qualcomm investors might be knowing this fact, but we had to establish this baseline for readers who haven’t been closely following Qualcomm’s balance sheet over the recent past.

Moving forward, Qualcomm reported in its latest quarterly filing that it had $32.4 billion in cash and cash equivalents as on September 25, 2016. In comparison, its dividend payouts for the entire fiscal year aggregated to just $2.9 billion. So, in theory, Qualcomm has enough cash cushion to pay its dividends about 11 times. The chipmaker also generated $6.86 billion in free cash flow during FY16 which is enough to cover its annual dividend payout 2 times over. So, prior to factoring in the NXP buyout, we can see that Qualcomm can sustain its dividends very comfortably.

But we’re here to discuss Qualcomm’s dividends after factoring in the NXP buyout, so let’s get to that.

The NXP Semiconductors NV (NASDAQ:NXPI) Impact

So far we’ve discussed that Qualcomm had about $32.4 billion in cash and cash equivalents at the end of Q4 (September quarter) and that the NXP buyout would cost $47 billion. If you noticed, there is a shortfall of $5.6 billion. Therefore, in order to bridge this gap, Qualcomm will tap its future cash flows and raise about $13.6 billion in debt once the buyout gets regulatory approval. The chipmaker announced that it has already lined up creditors for the debt raise, so getting the funds shouldn’t be a problem. And since Qualcomm isn’t debt-ridden, this debt raise shouldn’t wreck its balance sheet.

“We secured $13.6 billion in committed financing in connection with signing the definitive agreement.” – FY16 Annual Report (2).

But this is only one-half of the story and discusses just the funding shortfall. Where will the major chunk of cash come from? Simple, Qualcomm would be tapping its foreign cash balance to fund the major part of this $47 billion acquisition. This is a very encouraging statement for dividend investors and I’ll tell you why. (See also: QUALCOMM, Inc.: Is QCOM Stock A Great Buy For 2017?)

Follow Qualcomm Inc (NASDAQ:QCOM)

Follow Qualcomm Inc (NASDAQ:QCOM)

Receive real-time insider trading and news alerts