The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Community Financial Corp (NASDAQ:TCFC).

Hedge fund interest in Community Financial Corp (NASDAQ:TCFC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as ESSA Bancorp, Inc. (NASDAQ:ESSA), and Applied Therapeutics, Inc. (NASDAQ:APLT) to gather more data points. Our calculations also showed that TCFC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Jim Simons of RENAISSANCE TECHNOLOGIES

We’re going to take a gander at the key hedge fund action encompassing Community Financial Corp (NASDAQ:TCFC).

Hedge fund activity in Community Financial Corp (NASDAQ:TCFC)

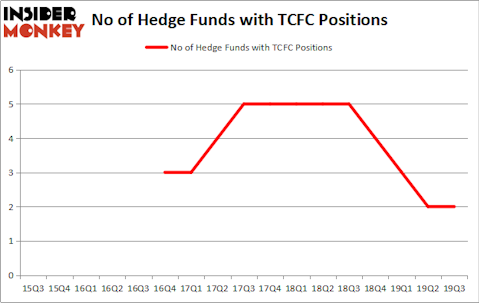

At Q3’s end, a total of 2 of the hedge funds tracked by Insider Monkey were bullish on this stock, the same as one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TCFC over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Private Capital Management was the largest shareholder of Community Financial Corp (NASDAQ:TCFC), with a stake worth $6 million reported as of the end of September. Trailing Private Capital Management was Renaissance Technologies, which amassed a stake valued at $2.4 million.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks similar to Community Financial Corp (NASDAQ:TCFC). These stocks are ESSA Bancorp, Inc. (NASDAQ:ESSA), Applied Therapeutics, Inc. (NASDAQ:APLT), and Esquire Financial Holdings, Inc. (NASDAQ:ESQ). This group of stocks’ market caps are closest to TCFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESSA | 2 | 11989 | 0 |

| CBNK | 2 | 480 | 1 |

| APLT | 3 | 9808 | 0 |

| ESQ | 4 | 5325 | 0 |

| Average | 2.75 | 6901 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.75 hedge funds with bullish positions and the average amount invested in these stocks was $7 million. That figure was $8 million in TCFC’s case. Esquire Financial Holdings, Inc. (NASDAQ:ESQ) is the most popular stock in this table. On the other hand ESSA Bancorp, Inc. (NASDAQ:ESSA) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Community Financial Corp (NASDAQ:TCFC) is even less popular than ESSA. Hedge funds dodged a bullet by taking a bearish stance towards TCFC. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately TCFC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); TCFC investors were disappointed as the stock returned 3.1% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.