Investment management company Vulcan Value Partners recently released its first-quarter 2023 investor letter. A copy of the same can be downloaded here. The firm has five strategies, and all gained positive returns and outperformed their respective benchmark indexes in the first quarter. The fund’s Large-Cap Composite returned 14.0% net of fees and expenses, the Small Cap Composite returned 8.1% net, the Focus Composite returned 20.4% net, the Focus Plus composite returned 20.4%, and the All-Cap Composite returned 16.8% net. You can check the top 5 holdings of the fund to know its best picks in 2023.

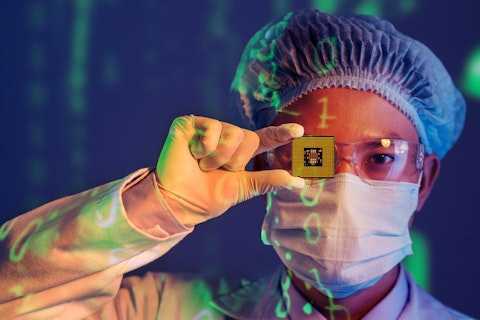

Vulcan Value Partners highlighted stocks like Applied Materials, Inc. (NASDAQ:AMAT) in the first quarter 2023 investor letter. Headquartered in Santa Clara, California, Applied Materials, Inc. (NASDAQ:AMAT) provides material engineering solutions for semiconductors, display, and related industries. On May 4, 2023, Applied Materials, Inc. (NASDAQ:AMAT) stock closed at $112.45 per share. One-month return of Applied Materials, Inc. (NASDAQ:AMAT) was -1.75%, and its shares lost 0.04% of their value over the last 52 weeks. Applied Materials, Inc. (NASDAQ:AMAT) has a market capitalization of $95.034 billion.

Vulcan Value Partners made the following comment about Applied Materials, Inc. (NASDAQ:AMAT) in its Q1 2023 investor letter:

“Applied Materials, Inc. (NASDAQ:AMAT) was a material contributor during the quarter. Despite a difficult environment, equipment revenue increased double digits. The company’s growth was supported by a nearly $20 billion backlog and strength in their lagging edge portfolio, driven by growth in semiconductor content for automotive, communications, sensors, and Internet of Things (IoT) end markets. Applied Materials also announced the promising new Centura Sculpa patterning system. This equipment will allow its customers to reduce their reliance on expensive EUV “double patterning”, which we believe will allow Applied Materials to gain share of the overall wafer fab equipment market. While we expect 2023 will be a down year for semiconductor capital equipment, we expect Applied Materials to return to growth in 2024. Overall, we feel positive about the company’s long-term outlook.”

Dragon Images/Shutterstock.com

Applied Materials, Inc. (NASDAQ:AMAT) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 70 hedge fund portfolios held Applied Materials, Inc. (NASDAQ:AMAT) at the end of the fourth quarter which was 67 in the previous quarter.

We discussed Applied Materials, Inc. (NASDAQ:AMAT) in another article and shared the list of best income stocks according to analysts. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 12 Best Video Game Stocks to Buy Now

- 10 Best Consumer Electronics Stocks To Buy

- Dividend Champions, Contenders and Challengers List

Disclosure: None. This article is originally published at Insider Monkey.