Good news for Apple Inc. (NASDAQ:AAPL) investors. According to the latest report from comScore MobiLens for February 2013, 133.7 million people in the U.S. owned smartphones (57% mobile market penetration) during the three months ending in February, up 8% since November, 2012.

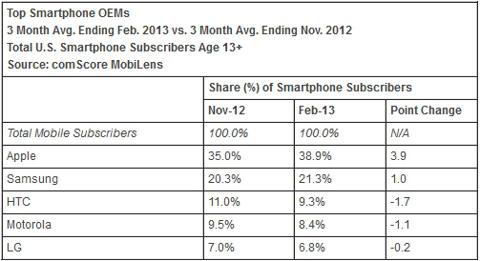

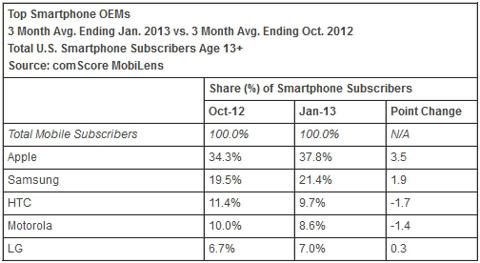

Apple Inc. (NASDAQ:AAPL) ranked as the top OEM with 38.9% of U.S. smartphone subscribers (up 1.1 percent points from January, 2013 and 3.9 percentage points from November, 2012). Samsung continued to be ranked second with 21.3%. HTC, Motorola, and LG all declined in February as compared to January results, as seen from the tables below.

Source: comScore

Source: comScore

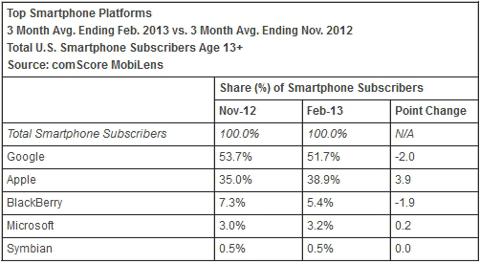

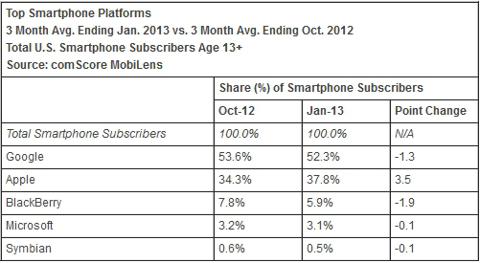

When evaluating the numbers for platform, Google Inc (NASDAQ:GOOG)‘s Android continued to rank as the top smartphone platform with 51.7% market share for February 2013. However, the market share had declined 0.6% as compared to January 2013.

Apple Inc. (NASDAQ:AAPL) had gained market share and increased 1.1% as compared to the previous month. Apple continued to increase it platform share from 34.3% in October 2012 to 38.9% in February 2013. Research In Motion Ltd (NASDAQ:BBRY) ranked third, but had lost 0.5% market share, while Microsoft Corporation (NASDAQ:MSFT) followed with a 0.1% increase compared to January numbers as seen from the tables below.

Source: comScore

Source: comScore

Earnings estimate and analysts’ calls

Analysts, on average, are expecting an EPS of $10.13 with revenue of $42.70 billion for the quarter ended March 2013. Apple Inc. (NASDAQ:AAPL) is expected to release Q2 2013 earnings on April 23, 2013. In the last four quarters, Apple has two positive and two negative earnings surprises.

On April 8, 2013, Canaccord Genuity analyst Michael Walkley raised Q2 and Q3 iPhone unit estimates to 37 million and 27 million from 34.5 million and 25 million, respectively, based on the observation of stronger sales of iPhone 4 and 4S models at reduced prices. The analyst also said iPhone 5 sales declined, but were “consistent with normal seasonal patterns.”

Competition

Research In Motion Ltd (NASDAQ:BBRY) and Nokia Corporation (ADR) (NYSE:NOK) continue to be in “come-back” mode. Research In Motion Ltd’s upcoming numbers should be lifted by the Z10 launch and the upcoming Q10 pre-orders. Research In Motion Ltd (NASDAQ:BBRY) is currently trading below its book value of $18.36. Research In Motion Ltd (NASDAQ:BBRY) has a healthy balance sheet, with $2.65 billion total cash and zero total debt.

Nokia Corporation (ADR) (NYSE:NOK) continues to receive positive feedback for its Lumia phones. Nokia has a healthy balance sheet with $13.13 billion total cash and $7.25 billion total debt. Analysts are estimating an EPS of $(0.05) with revenue of $8.65 billion for the current quarter ending in March 2013. Nokia Corporation (ADR) (NYSE:NOK) is expected to release its Q1 2013 earnings on April 18, 2013.

While both companies have a long-way to regain their market shares, both have the potential to become the top turnaround stories of 2013.

Earlier, as reported by Bloomberg, HTC posted its lowest quarterly profit on record, and missed its revenue target due to the delay of its newest flagship phone. Despite HTC’s new Facebook phone and improved production, HTC continues to face a tough road ahead with upcoming devices from competitors, including Samsung’s new Galaxy S4, which goes on sale in the U.S. on April 26.

(Featured image credit: Apple Inc. (NASDAQ:AAPL) advertising, by B2)

Samsung, on April 5, had released its preliminary estimate for an operating profit of 8.7 trillion won (US$7.7 billion) for Q1 2013. The estimate was 52.9% increase from a revised operating profit a year earlier, but was 1.6% lower than the previous record quarter, which was boosted by strong sales of its Galaxy S3 and Galaxy Note 2 smartphones. Samsung is scheduled to announce its first-quarter earnings later this month.

Bottom Line

From the fundamental perspective, Apple Inc. (NASDAQ:AAPL) is unbeatable and cheaply valued with a low Forward P/E of 8.2 and an inexpensive free cash flow (P/FCF of 9.14). Apple is also gaining market share, but its stock remains under pressure since its peak in mid-September 2012 due to various concerns, including slower growth and capital allocation concerns. At this moment, Apple is attractively valued, but may not be suitable for investors with limited risk appetite as its volatility continues.

Note: Investors and traders are recommended to do their own due diligence and research before making any trading/investing decisions.

Nick Chiu has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple Inc. (NASDAQ:AAPL)